Why i bet on ETH in 2016 and skipped XRP

Back in 2016, when I first got into crypto, everyone was hyped about Ripple (XRP). But me? I never bought it. Not even a single coin. Let me tell you why.

At the time, I had my own hardware online store and stumbled into Ethereum mining. I had no idea how Ethereum worked, smart contracts, decentralized apps, the whole shebang. And mining? it was a challenge, so I just clicked, and built a mining rig with 2 GPUs (Graphics Cards) at first. it was interesting I started to search for motherboards with more PCI slots to fit more GPUs in one rig Plus, Ethereum felt like the future. Ripple, on the other hand? Eh, it didn’t sit right with me, just worldwide transfers sounded nothing like cheap Western Union to me.

“XRP was designed to be a better Bitcoin.” With cheaper and faster transactions and a scalable network, XRP has addressed Bitcoin’s major flaws and could see significantly more adoption now that the lawsuit is over.” —David Schwartz, Chief Technology Officer at Ripple

The XRP Buzz Back Then

Ripple was like the rising star of 2016. “Banks are gonna love it,” they said. “It’ll revolutionize cross-border payments,” they promised. And sure, it had partnerships with big financial institutions. But here’s the thing: XRP isn’t decentralized. Ripple Labs owns a huge chunk of the supply, and whenever the price went up, they’d dump some coins on the market. That’s like meme coin rug-pull vibes, right?

Fast forward to today, XRP still hasn’t hit its all-time high from 2017. And honestly, I’m not surprised. Why? Because Ripple’s focus has always been more about making money for the company than building value for investors. It’s like they’re saying, “Thanks for the cash, but we’ve got bills to pay.”

“one of the most scalable and efficient digital assets available for cross-border payments.” — World economic Forum

Meanwhile, Ethereum…

Let’s talk about why Ethereum kept climbing. First, people need ETH. It’s the fuel that powers the network. Wanna deploy a smart contract? (my first impression about smart contract was you can code anything like time, date, anything and it will be executed as you code it, it felt futuristic) and You need ETH to run it.

later was developed NFTs, DeFis Yep, ETHereum has innovated all this. The ecosystem grew because of its utility, not just speculation.

And those use cases? They’re wild. Decentralized finance (DeFi), NFTs, DAOs—these weren’t just buzzwords; they were game-changers. Back in 2016, I didn’t fully grasp how big Ethereum would get, but I knew it had potential. I mean, the idea of programmable money? That’s sci-fi-level stuff.

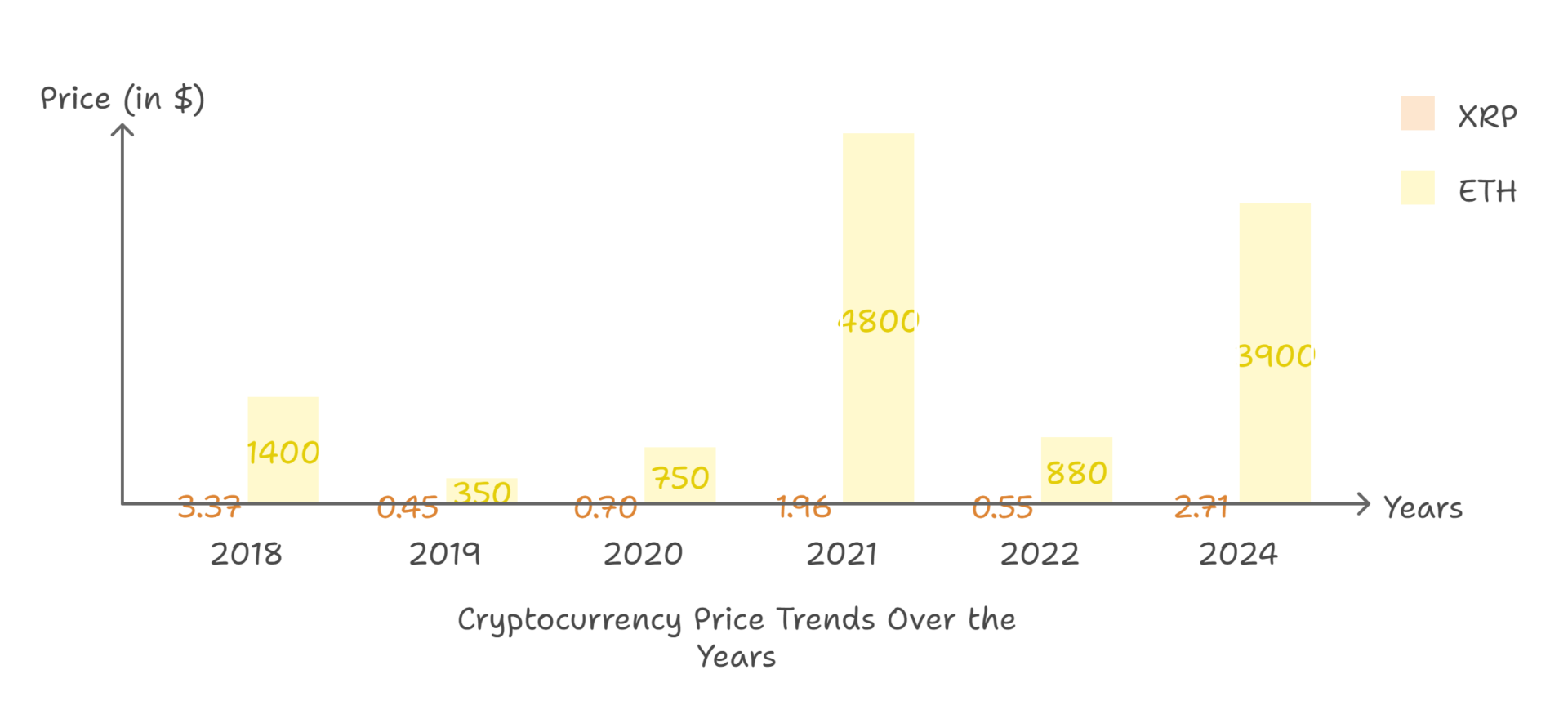

Let’s crunch some numbers with recent stats:

2018: Both ETH and XRP soared at the start of 2018, riding the wave of the 2017 bull run. ETH hit a high of around $1,400, while XRP reached its all-time high of $3.37 in January. But the party didn’t last long. By the end of the year, ETH tumbled below $100, a massive 93% drop from its peak. XRP mirrored the decline, sinking to $0.28—a significant fall from its glory days.

2019: For Ethereum, 2019 marked a slow recovery. It peaked at $350 during the summer rally but mostly stayed between $100–$150, showing resilience despite a bearish market. XRP, on the other hand, struggled. It briefly climbed to $0.45 but ended the year at $0.20, reflecting lower market interest as Ripple’s centralized tokenomics and ongoing criticisms weighed it down.

2020: This was the year of resurgence—at least for Ethereum. After briefly dipping below $100 during the COVID-19 market crash, ETH closed the year near $750, fueled by the DeFi boom and Ethereum 2.0 staking excitement. XRP also saw a recovery, peaking at $0.70 in December, but its momentum was short-lived as Ripple faced a lawsuit from the SEC, tarnishing investor confidence.

2021: ETH hit an all-time high of about $4,800, with a low of $1,780. XRP, on the other hand, peaked at $1.96 and dropped to $0.51.

2022: During the crypto winter, ETH’s low was around $880, but it held stronger compared to XRP, which hovered between $0.29 and $0.55.

2024 (Today, Dec 11): ETH is sitting at $3,900, while XRP is at $2.71. Ethereum’s still driving the blockchain ecosystem, while XRP feels like it’s just… there.

The Ripple Problem

Here’s what really bugged me about Ripple. The company holds most of the XRP supply. Every time the price spikes, they cash out. That’s great for them but awful for regular investors. It’s like they’re dangling a carrot, but as soon as you reach for it, they pull it away.

With Ethereum, you’ve got something real. Developers are constantly building on it, and the network keeps improving. It’s decentralized, and no single entity can pull the rug on you. Plus, the Ethereum community? It’s massive. That kind of collective energy is hard to beat.

Why I’m Glad I bet on ETH

Looking back, I feel like I dodged a bullet. Ripple might’ve had its moment, but Ethereum’s the one that keeps giving. It’s not just an investment; it’s the backbone of an entire ecosystem. Whether it’s DeFi, NFTs, or staking, Ethereum stays relevant.

Honestly, sticking with ETH wasn’t some genius move.

It was just me going with what I knew. But sometimes, that’s all it takes. You pick what feels right and trust the process. And hey, if you’re thinking about diving into crypto now, maybe take a closer look at the projects with actual utility. Trust me, it makes all the difference.

So yeah, that’s why I never bought XRP. No regrets.

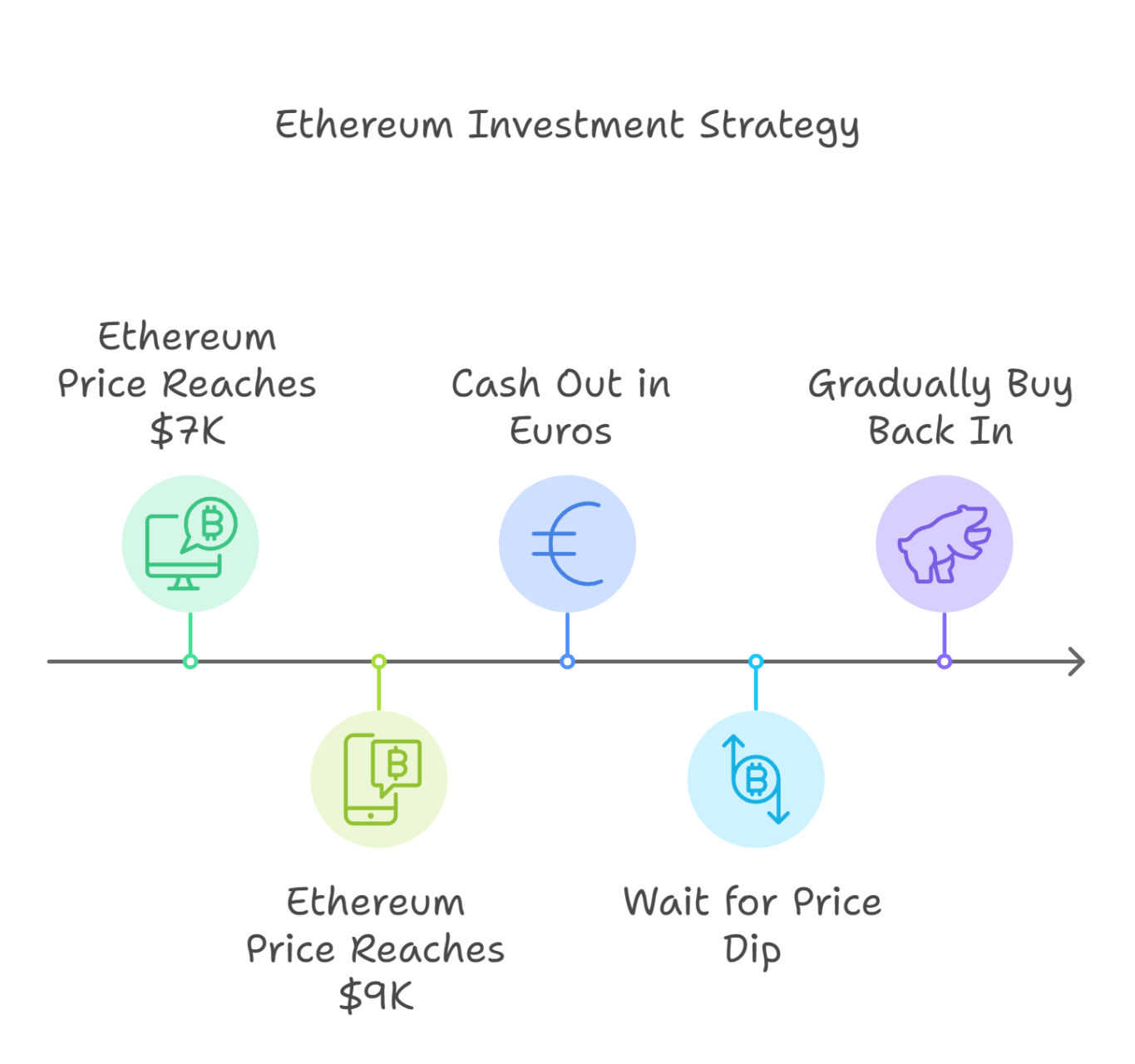

My ETH Exit Strategy

Now, let’s talk about the plan. I’ve been holding Ethereum for years, but even the best investments need an exit strategy. If ETH hits $7K, I’ll start selling gradually. Not all at once, though I’m not about to empty my bags in one go. If it manages to reach $9K, that’s a bonus, but honestly, I’m not betting the house on it, I’m not selling more than 50% anyway.

Here’s the twist: I’m not converting into stablecoins like USDT or USDC. Instead, I’m cashing out into good old euros. Why? Because in Germany, where I live, holding crypto for over a year means I can cash out tax-free. Yep, you read that right—zero taxes. So, I’m taking advantage of that sweet deal.

But I’m not abandoning ship completely. My plan is to wait for a good dip—somewhere in the $1,600 to $2,400 range—then gradually buy back in. Timing the market isn’t easy, but with a strategy in place, I can avoid panic buying or selling.

That’s just my plan, though. You do your own math, think long-term, and make decisions based on what works for you. Crypto isn’t one-size-fits-all, so play it smart!

more about ethereum