Why Europe Sees Bitcoin as a Hedge against Inflation

As inflation rises in Europe, many are turning to Bitcoin as a hedge against inflation, offering a modern alternative to protect wealth.

1. Bitcoin’s Limited Supply Protects Against Currency Devaluation

One of Bitcoin’s biggest advantages as a hedge against inflation is its limited supply. There will only ever be 21 million bitcoins. Unlike traditional currencies that can be printed in unlimited quantities, Bitcoin’s supply is capped. This scarcity makes it more resistant to devaluation, especially during times of inflation.

Central banks in Europe, including the European Central Bank (ECB), have been printing more money to support economic recovery. This has led to concerns about currency devaluation. When more money is printed, the value of the euro declines, reducing purchasing power.

However, Bitcoin cannot be manipulated in the same way. Its supply is fixed, and no central authority can change it. For many Europeans, this makes Bitcoin an attractive hedge against inflation.

Bitcoin’s Role in Europe’s Inflation Crisis

The Eurozone has faced significant inflation challenges in recent years. As inflation rises, the value of money decreases, and people look for ways to protect their wealth. Bitcoin’s scarcity makes it appealing, offering a digital alternative to traditional assets like gold, which has long been used as a hedge against inflation.

2. Decentralization Keeps Bitcoin Free from Central Bank Policies

Bitcoin’s decentralized nature is another reason it’s seen as a hedge against inflation. Unlike the euro, which is controlled by central banks, Bitcoin operates on a decentralized blockchain. No single authority, government, or organization controls it.

When central banks, like the ECB, make decisions about interest rates or print more money, it can directly impact inflation. However, Bitcoin is free from these influences. This decentralization protects it from the inflationary effects of government policies.

Why Europeans Value Bitcoin’s Independence

Europeans, particularly in countries facing economic instability, are increasingly turning to Bitcoin. Countries with struggling economies, such as Greece and Turkey, have seen a surge in Bitcoin adoption as their local currencies have lost value. For those looking to protect their wealth from inflation, Bitcoin offers a reliable alternative because it isn’t tied to any government’s monetary policy.

3. Bitcoin Offers Global Access and Liquidity

Another reason Bitcoin is viewed as a hedge against inflation is its global nature. It can be accessed, bought, and sold from anywhere in the world, at any time. This makes Bitcoin a convenient option for Europeans who want to protect their wealth from local inflationary pressures. Unlike other assets, such as real estate or government bonds, Bitcoin offers liquidity. It can be easily traded or converted into cash.

Bitcoin as a Hedge Against Inflation is Universal

The euro is not the only currency struggling with inflation. Many currencies around the world are losing value, and Bitcoin offers a global hedge. Europeans can invest in Bitcoin knowing that its value isn’t tied to the euro alone. This makes it a versatile option for those looking to protect themselves from inflation, regardless of where they live in Europe.

4. Growing Institutional Adoption Increases Bitcoin’s Credibility

In recent years, Bitcoin has gained significant attention from institutional investors in Europe. Major European banks, hedge funds, and even pension funds are starting to include Bitcoin in their portfolios. This growing institutional support is one of the key reasons Bitcoin is increasingly seen as a hedge against inflation.

The approval of Bitcoin ETFs (exchange-traded funds) in Europe has made Bitcoin more accessible to investors. This new investment vehicle allows people to invest in Bitcoin without having to buy and store it themselves. As more institutional investors embrace Bitcoin, its credibility as a hedge against inflation grows.

Why Institutional Adoption Matters

Institutional adoption signals trust in Bitcoin as a legitimate asset class. When large financial institutions begin investing in Bitcoin, it shows that they believe in its long-term value. For individual investors in Europe, this adds another layer of confidence in using Bitcoin as a hedge against inflation.

5. Bitcoin’s Historical Performance During Inflationary Periods

Historically, Bitcoin has performed well during periods of economic uncertainty and rising inflation. Its price tends to rise as people seek alternatives to traditional assets. This has been especially true in Europe, where rising inflation has pushed more investors to consider Bitcoin.

Bitcoin’s Track Record in Inflationary Europe

During the global inflation spikes of 2021 and 2022, Bitcoin outperformed many traditional assets. While it is true that Bitcoin can be volatile, its long-term upward trend has attracted more investors looking for a hedge against inflation. Many Europeans have found that Bitcoin’s performance during inflationary periods provides a level of protection that other assets simply can’t offer.

In 2021, Bitcoin hit an all-time high of $69,000 in November, as inflation rates spiked across Europe and other regions. The Eurozone’s inflation rate reached 4.9% by the end of 2021, its highest in over a decade, prompting many Europeans to seek alternatives to protect their purchasing power.

During 2022, inflation worsened across Europe, with the Eurozone experiencing rates above 8% for much of the year, reaching a peak of 10.6% in October. Despite the broader market volatility, Bitcoin maintained a strong presence in portfolios, with prices fluctuating between $27,000 and $48,000 throughout the year. Many viewed Bitcoin as a way to hedge against the weakening euro and rising prices, even during these volatile times.

is Using Bitcoin as a Hedge the Future of Inflation Hedging in Europe?

With inflation continuing to rise in Europe, more people are looking for ways to safeguard their wealth. Bitcoin’s limited supply, decentralized nature, global access, and growing institutional support make it an increasingly attractive hedge against inflation. yesterday European central bank projected BTC logo on its building, probably nothing.

Bitcoin offers a modern solution to an age-old problem. As inflation erodes the value of traditional currencies, Bitcoin stands out as a reliable alternative. Whether or not it will replace traditional hedges like gold remains to be seen, but for now, it’s clear that Bitcoin is becoming a key player in Europe’s fight against inflation.

Why Europeans Are Turning to Bitcoin

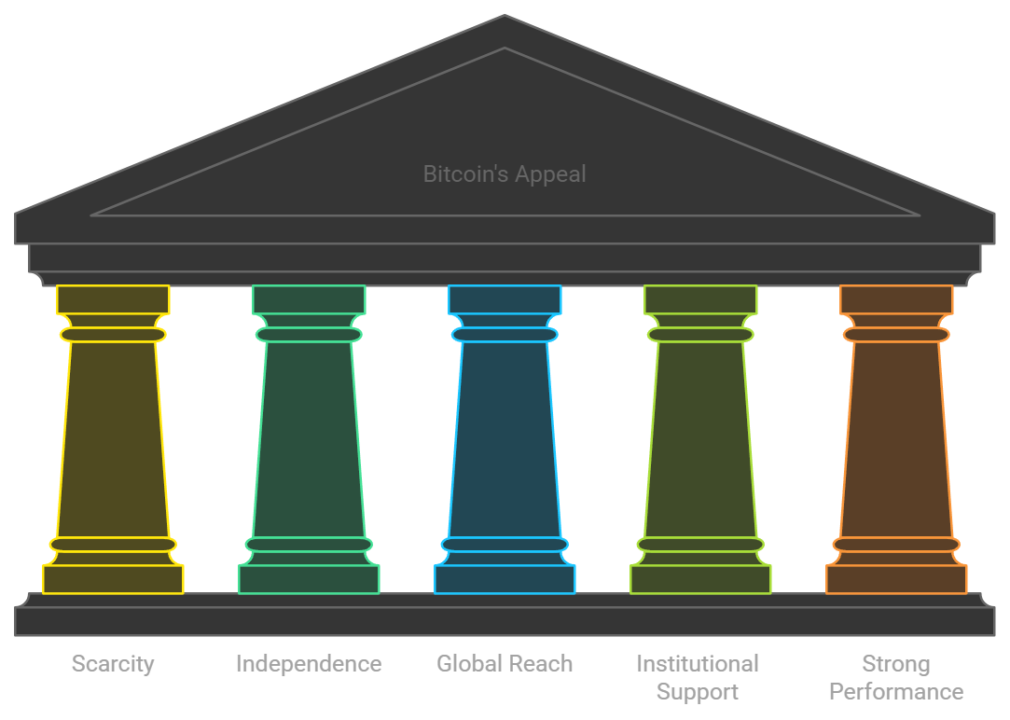

- Scarcity: Bitcoin’s fixed supply protects against devaluation.

- Independence: Decentralization shields it from central bank policies.

- Global Reach: Accessible to anyone, anywhere.

- Institutional Support: Increased adoption boosts credibility.

- Strong Performance: A proven track record during inflationary periods.

Conclusion: A Growing Role for Bitcoin in Europe’s Financial Future

In an era of rising inflation, Bitcoin is quickly becoming a go-to asset for Europeans looking to protect their wealth. Its unique features, such as a limited supply and decentralization, make it an appealing alternative to traditional hedges like gold. As institutional adoption continues to grow, Bitcoin’s role as a hedge against inflation in Europe will likely become even more prominent.

For European investors, Bitcoin offers a way to stay ahead of inflation, providing security in uncertain economic times. As inflation continues to affect the value of the euro and other currencies, Bitcoin’s popularity as a hedge is likely to rise.

read more about Bitcoin

One Comment