Solana vs. Sui: Which is Better in 2025? A Crypto Comparison

Founders and Funding: Solana and Sui

When diving into the world of cryptocurrency, it’s essential to understand the origins and financial backing of each project. Solana and Sui both have unique stories, shaped by their founders and the funding they’ve raised, giving each its distinct position in the crypto space.

Solana was founded in 2017 by Anatoli Yakovenko, a former engineer at Qualcomm, a major tech company. His vision was to create a blockchain that could scale significantly while maintaining low transaction costs. The result was Solana, a blockchain with an impressive capacity for transactions.

Solana’s journey started with significant support from initial coin offerings (ICOs), raising $25 million from early backers who believed in its potential. As the project grew, it caught the attention of venture capitalists, who contributed an additional $314 million. These funds were vital in boosting Solana’s development, enabling it to grow its ecosystem rapidly.

However, Solana’s rise wasn’t without bumps. The project was affected by the collapse of FTX, one of the largest cryptocurrency exchanges, which had close ties with Solana. While FTX’s downfall caused market turbulence, Solana continued to push forward, showcasing resilience in challenging times.

On the other hand, Sui emerges from a different background. It was created by a team with experience working on Meta’s (formerly Facebook’s) failed Libra project. Libra was Facebook’s ambitious plan to create a global cryptocurrency, but it faced regulatory scrutiny and eventually failed to launch. This experience shaped the Sui team’s approach to building a more efficient and scalable blockchain.

While Sui is newer compared to Solana, it has still managed to raise a staggering $400 million through ICOs. This funding has allowed the project to grow quickly and stand out from other emerging blockchains. Notably, Sui made a significant move by buying back tokens from FTX, protecting their project from some of the fallout that impacted the broader crypto industry. This proactive approach shows the team’s capability to navigate tough situations.

In summary, Solana has a longer track record, but Sui’s strong backing and strategic decisions, like the token buyback, put it in a solid position. Both have ample funding, but the way they handle challenges like the FTX collapse reflects their distinct strategies for success.

Technology: A Battle of Speed and Innovation

The technology behind these blockchains is another critical factor that differentiates Solana and Sui. In the fast-moving world of crypto, efficiency and speed are often the name of the game. Each blockchain has taken a different approach to achieve this.

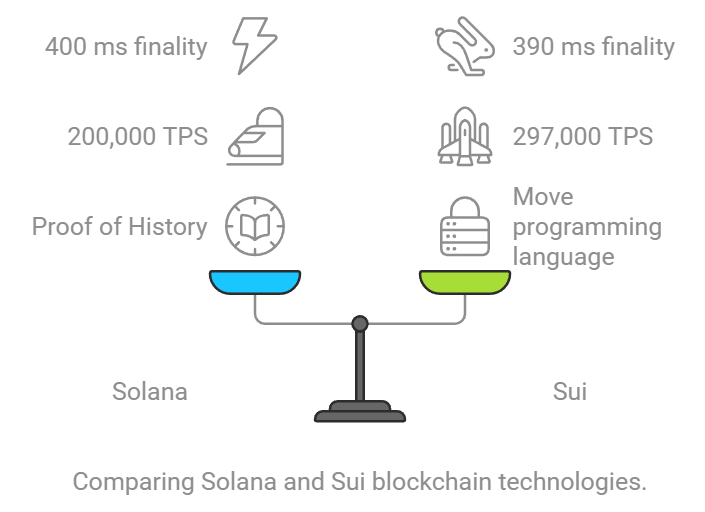

Solana utilizes a combination of proof-of-stake (PoS) and a unique innovation called Proof of History (PoH). This technology allows the network to handle up to 200,000 transactions per second (TPS), which is exceptionally high compared to many other blockchains. Proof of History enables Solana to timestamp transactions without needing all nodes to communicate frequently, reducing delays. The result? A block time of just 400 milliseconds, making Solana one of the fastest blockchains available.

Furthermore, Solana is continuously evolving. One of its latest innovations is the Fire Dancer, a new validator client designed to enhance security and boost the network’s performance even further. This ongoing development shows Solana’s commitment to staying at the forefront of blockchain technology.

Sui, in contrast, leverages delegated proof-of-stake (DPoS), a slightly different consensus mechanism that also emphasizes speed and scalability. Sui’s DPoS system allows it to process up to an impressive 297,000 transactions per second (TPS), putting it ahead of Solana in raw transaction capacity. Additionally, Sui stands out for using the Move programming language, which was developed during the Libra project. Move is designed to optimize the execution of smart contracts and increase security by reducing vulnerabilities commonly found in other programming languages used in blockchain.

In terms of transaction finality, Sui also edges out Solana with a finality time of 390 milliseconds—just slightly faster than Solana’s 400 milliseconds. This faster finality ensures transactions are confirmed more quickly, which is a crucial factor for real-time applications like gaming and decentralized finance (DeFi).

While both blockchains offer groundbreaking technology, Sui’s Move language gives it a unique edge in terms of development flexibility, while Solana’s ongoing innovation, like the Fire Dancer, ensures it remains a major player in the blockchain ecosystem.

Tokenomics & Price Potential: The Numbers Behind the Hype

The tokenomics of a cryptocurrency—the structure behind how its tokens are issued, used, and valued—play a major role in its long-term success and attractiveness to investors.

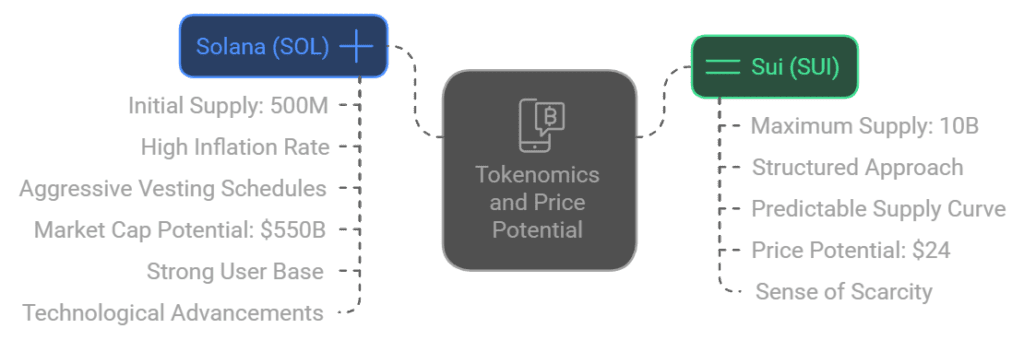

Solana (SOL) launched with an initial supply of 500 million tokens. However, one aspect that has caused concern for some investors is its high inflation rate. This inflation is driven by aggressive vesting schedules for early investors and developers, which means more tokens are regularly entering circulation. While this could put downward pressure on the token’s price in the short term, the overall market sentiment around Solana remains positive. Its market capitalization has the potential to grow as high as $550 billion, depending on adoption and the broader crypto market’s growth. Despite inflationary concerns, Solana’s strong user base and technological advancements keep it competitive.

Sui (SUI), on the other hand, takes a more structured approach with a maximum supply of 10 billion tokens. This clear cap creates a more predictable supply curve, which many investors find appealing. Analysts predict that at the peak of its market cycle, SUI’s price could reach as high as $24 per token. While the token supply is significantly larger than Solana’s, the capped limit offers a sense of scarcity that may support price growth over time.

In terms of long-term potential, both tokens show promise, but their differing approaches to tokenomics will likely appeal to different types of investors. Solana offers the excitement of potentially high growth but with the risk of inflation, while Sui presents a more controlled, steady approach to token issuance.

Adoption: Who’s Using Solana and Sui?

Adoption is often the ultimate test for any cryptocurrency. The more people use it, the more valuable the network becomes.

Solana is already a proven leader in adoption. With over 5 million monthly active wallets, it’s clear that Solana has captured a large audience. Its strong presence in DeFi is also a significant indicator of its success, with $5 billion in total value locked (TVL) across various DeFi platforms built on Solana. Additionally, Solana has ventured into hardware with the Saga phones, which natively support Solana’s blockchain. This integration of hardware and blockchain shows Solana’s innovative approach to expanding its ecosystem beyond just software.

Sui claims to have 5 million active wallets as well, though its DeFi user base is notably smaller than Solana’s. However, Sui is making strides in other areas, particularly with its Sui Play handheld gaming device. By focusing on gaming, Sui is targeting a niche that could help it carve out a dedicated user base. As gaming becomes an increasingly popular use case for blockchain, Sui’s focus on this sector might prove to be a smart strategy for long-term growth.

Challenges: What Could Hold Them Back?

Despite their successes, both Solana and Sui face significant challenges that could impact their future growth.

For Solana, the primary issue has been its network outages. These interruptions in service have caused frustration among users and developers alike, raising concerns about the reliability of the network. Additionally, Solana’s dependency on venture capital has drawn criticism, as some fear it may lead to centralization. If the development process becomes too complex or burdensome, developers might choose to build on other blockchains like Sui.

Sui, meanwhile, faces its own set of challenges. One of the biggest is the complexity of the Move language. While it offers benefits in security and functionality, it also makes development more difficult for those who are unfamiliar with it. This could limit the number of developers who are willing to build on Sui. Moreover, Sui’s offshore status might pose regulatory challenges, making it harder for the project to gain institutional support compared to other blockchains based in more favorable jurisdictions.

Conclusion: Solana or Sui?

At the end of the day, both Solana and Sui offer exciting opportunities for investors and developers. Solana has the advantage of a larger user base and a more mature ecosystem, but it struggles with network reliability and faces pressure from newer projects like Sui. Sui, on the other hand, brings fresh technology and a focus on gaming, but it still needs to overcome challenges in adoption and development.

For investors, holding both tokens could be a wise strategy, as it provides a hedge against potential risks in either network. Solana offers proven reliability and strong DeFi integration, while Sui could be a dark horse with its focus on gaming and innovative technology. Ultimately, the choice between Solana and Sui depends on your risk tolerance and vision for the future of blockchain.

more about Altcoins