How to Avoid Scams: 10 Essential Tips for Staying Safe in Crypto

In this guide, we’ll show you how to avoid scams and protect yourself from fraud. With these simple, practical tips, you can confidently navigate the crypto world and keep your investments safe from scammers.

1. Avoid Phishing Scams

Phishing is one of the oldest tricks in the cybercriminal’s book, and it’s still going strong in the crypto space. These scams often come disguised as emails, fake websites, or social media messages that look like they’re from legitimate exchanges or services.

Phishing attempts usually try to trick you into entering your login credentials or downloading malicious software. The consequences? Access to your account can be stolen, and your funds drained.

How to avoid phishing scams:

- Always double-check the URL before logging into a website.

- Don’t click on unsolicited links in emails or social media messages.

- Be cautious of emails asking for your password or private information.

It’s also important to note that reputable companies will never ask for your login details through email. Forget about clicking links sent from strangers!

2. Beware of Fake Exchanges and Wallets

Fake exchanges and wallets can be incredibly deceptive. Scammers create platforms that closely resemble legitimate exchanges or wallet services to trick users into entering sensitive information. Once you’ve entered your credentials, they gain access to your funds. I will drop the links of the wallets that i have been using for years already at the bottom of this post.

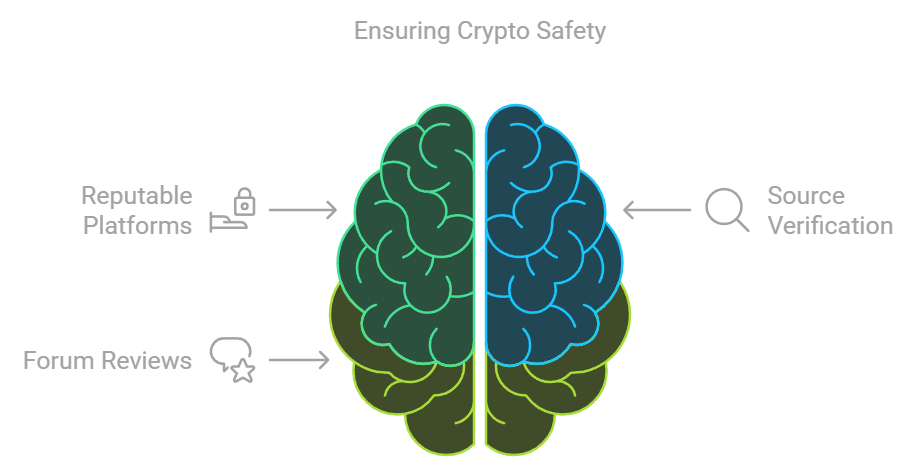

Tips to stay safe:

- Stick to well-known and reputable platforms.

- Always verify the source before downloading any wallet app or software.

- Look for reviews or mentions of the exchange on trusted crypto forums.

The more research you do before signing up for a service, the better.

3. Don’t Fall for “Guaranteed Returns”

Cryptocurrency markets are volatile. No one can accurately predict market movements, and certainly, no one can guarantee profits. If someone promises high returns with little to no risk, they’re likely running a scam, such as a Ponzi scheme. there is no guarantee in Crypto the one and only is BTC but you should understand the bull and bear markets timing, more about it in another article.

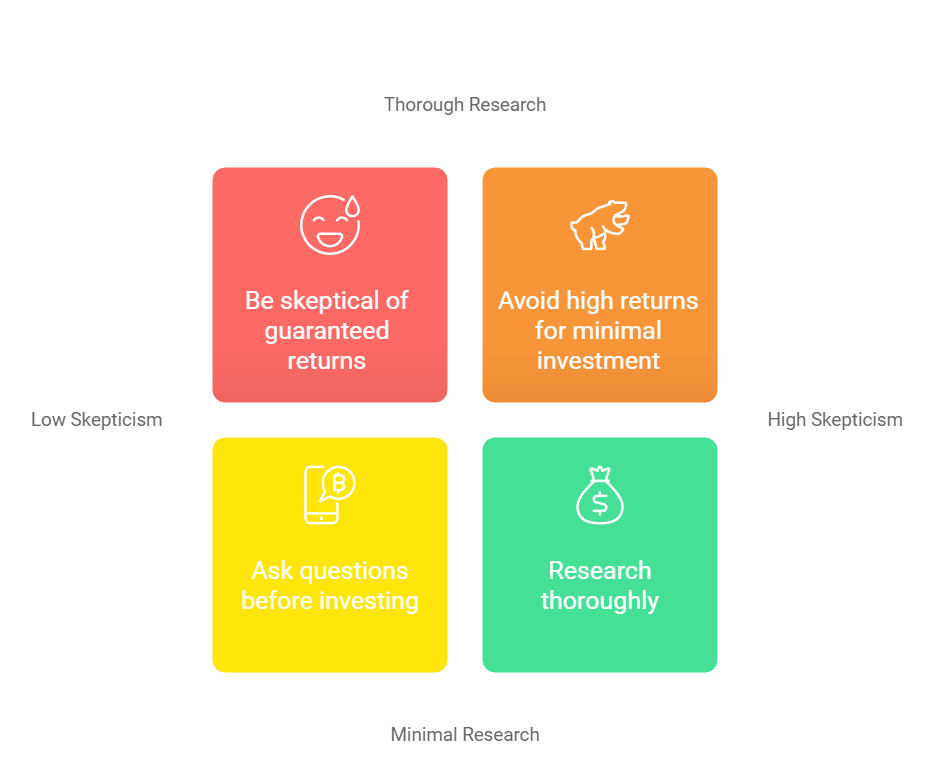

To protect yourself:

- Be skeptical of anyone claiming “guaranteed returns.”

- Stay away from platforms promising unusually high returns for minimal investment.

- Always ask questions and research thoroughly before parting with your money.

Remember, if something sounds too good to be true, it probably is a scam. there is no win win situation someone’s got to loose, another to win, if both party is winning then third party is loosing.

4. Avoid Scams, Fake Airdrops and Giveaways

Fake airdrops and giveaways are common scams, particularly on social media. Fraudsters often ask for a “small fee” or your private keys in exchange for large amounts of free crypto.

Legitimate airdrops never ask for personal information, including private keys or any sort of payment.

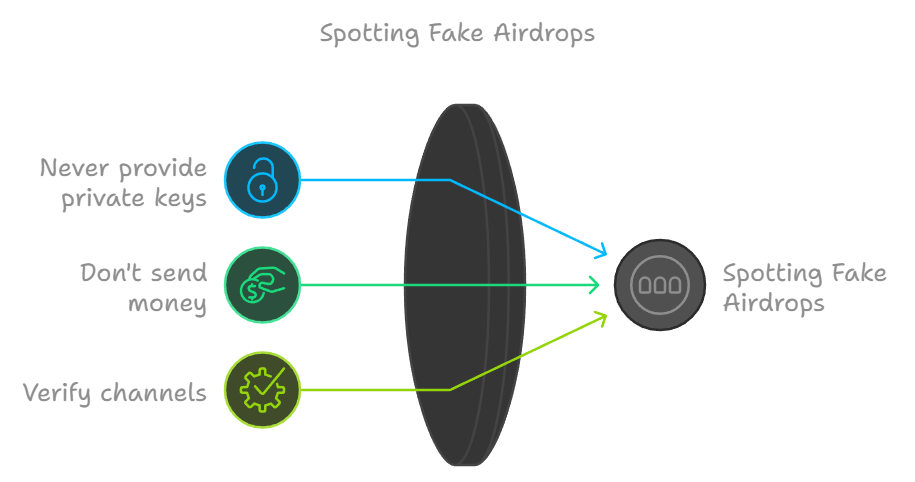

How to spot fake airdrops:

- Never provide your private keys or seed phrases.

- Don’t send money to participate in an airdrop or giveaway.

- Look for official channels to verify legitimate airdrops.

A simple rule: if an offer requires you to send money or sensitive information, it’s probably a scam. private keys are called private for a reason only you should know it.

5. Use Hardware or Paper Wallets, for Large Holdings

If you’re storing a significant amount of cryptocurrency, a hardware wallet, also known as cold storage, is essential. By keeping your private keys offline, you greatly reduce the risk of hacks or phishing attacks.

Benefits of hardware wallets:

- Your private keys are stored offline, making them less vulnerable to online attacks.

- You control the keys, meaning you’re the only one with access to your funds.

- Even if your computer gets hacked, your funds remain secure.

Investing in a hardware wallet is one of the best ways to protect your crypto assets long-term. but don’t be this guy

6. Watch Out for Fake Support Teams

Scammers often pose as customer support representatives from exchanges or wallet services, especially on social media. They’ll claim to help resolve an issue, but in reality, they’re trying to get your private keys or access to your account.

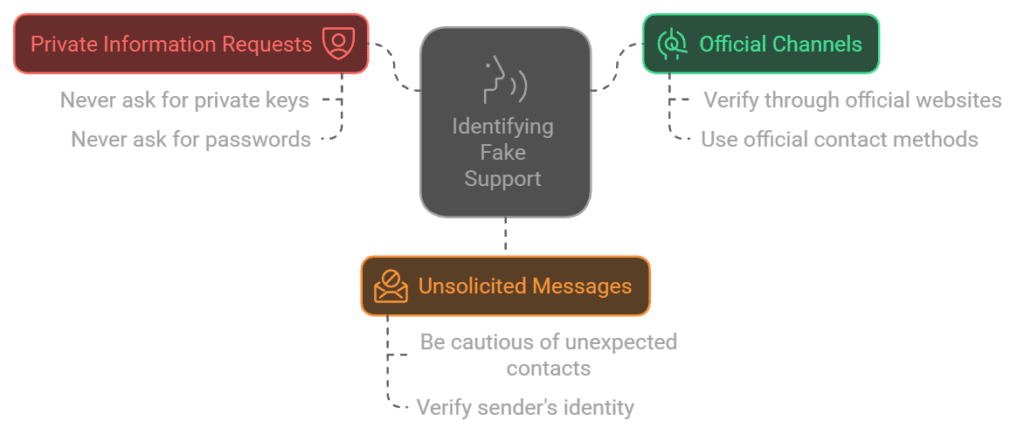

How to identify fake support:

- Legitimate customer support will never ask for your private keys or password.

- Always reach out to official support channels.

- Be cautious of unsolicited messages from “support” representatives.

If you receive a message from someone claiming to be support, verify their identity through official platforms before engaging.

7. Verify Before You Invest in ICOs or New Projects

Initial Coin Offerings (ICOs) and new cryptocurrency projects can be enticing, especially if they promise groundbreaking technology or huge returns. However, many of these are scams designed to take your money and disappear. we will be posting our researches about Altcoins here

To avoid falling for fraudulent ICOs:

- Research the team behind the project. Are they legitimate?

- Read the whitepaper carefully. Does it seem realistic?

- Check community feedback. Do users trust this project?

Always do your due diligence before investing in any new project.

8. Be Skeptical of Pump and Dump Schemes

Pump and dump schemes involve artificially inflating the price of a cryptocurrency, getting people to invest, and then selling off large amounts, causing the price to crash. These schemes are illegal and can leave investors with significant losses.

How to avoid scams in pump and dump traps:

- Don’t fall for social media groups hyping up coins without solid reasoning.

- Be wary of promises of quick profits from buying into a project.

- Watch out for unusually high trading volumes followed by a sudden price surge.

If you’re caught in a pump and dump, you’ll likely lose all your investment. avoid day trading and futures, especially if are new in crypto my advice from my own experience.

9. Use Two-Factor Authentication (2FA)

One of the simplest ways to secure your accounts is by enabling two-factor authentication (2FA). With 2FA, even if someone has your password, they’ll still need a second form of verification—usually a code sent to your phone—to access your account.

Why you should enable 2FA:

- Adds an extra layer of security to your accounts.

- Reduces the risk of account takeover, even if your password is compromised.

- Simple to set up and easy to use.

Ensure you enable 2FA on all of your crypto exchange accounts and wallets.

10. Keep Your Private Keys and Seed Phrases Secure

Your private keys and seed phrases are the most sensitive pieces of information when it comes to your crypto holdings. If someone has access to these, they can take control of your funds. Storing them securely is crucial.

Best practices for securing private keys:

- Never share them with anyone.

- Avoid storing them online (e.g., in your email or cloud storage).

- Write them down and keep them in a secure, offline location.

Losing access to your private keys or seed phrases means losing access to your crypto—permanently.

Final Thoughts: Stay Cautious and Informed

The world of cryptocurrency can be thrilling, but it’s essential to stay cautious and informed. Scammers are always evolving their tactics, so you must stay one step ahead. By following the tips in this guide, you’ll significantly reduce your risk of falling victim to cryptocurrency scams.

Always remember:

- If it sounds too good to be true, it probably is a scam.

- Do your research before trusting a new platform, service, or individual.

- Keep your private keys and secret phrases safe and secure at all times.

By staying vigilant, you’ll be able to enjoy the benefits of cryptocurrency without the fear of being scammed. Choose the right wallet for you and stay safe, don’t hesitate to ask questions if you have some.