El Salvador’s Weird Move: Why Adopting Bitcoin as Legal Tender

Let me take you back to 2021, when El Salvador pulled off one of the boldest moves in financial history. This small Central American nation shocked the world by declaring Bitcoin a legal tender. For someone like me who’s been in crypto since the days of sweaty GPU mining rigs (hello, Ethereum)—this was huge. But also…kind of risky, right? So, why did they do it, and what’s the game plan here? Let’s break it down.

Why Did El Salvador Go All-In on Bitcoin?

It all started in June 2021, when President Nayib Bukele announced that Bitcoin was about to become the official currency alongside the U.S. dollar. By September, it was a done deal, with the Bitcoin Law officially in effect. Bold move, but what’s the why behind it? Turns out, El Salvador had some serious economic problems and Bitcoin looked like a potential solution.

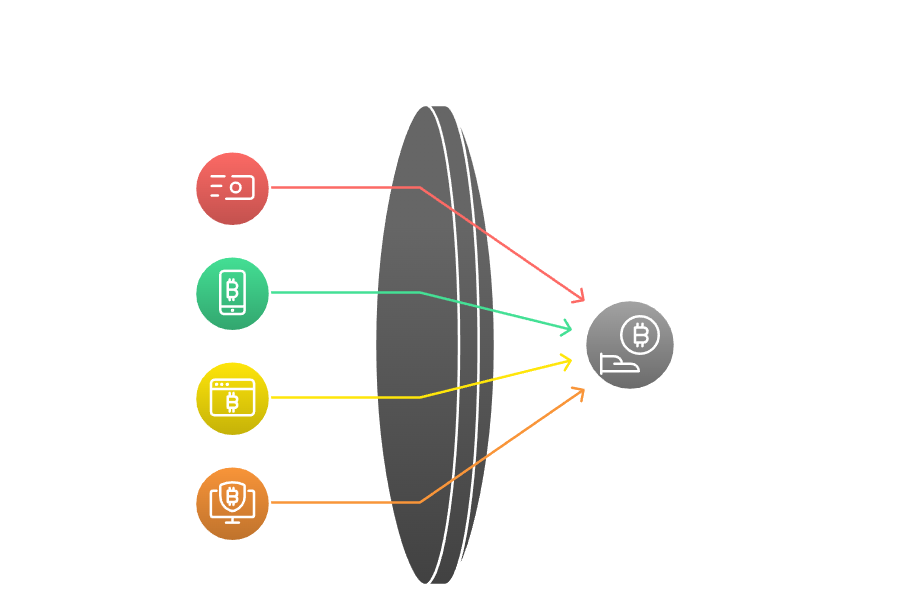

1. Remittances: Getting Rid of the Fee Vampires

Imagine sending money back to your family and watching a chunk of it vanish into the pockets of middlemen like Western Union. That’s been the reality for millions of Salvadorans abroad, and these remittances make up nearly 20% of the country’s GDP. Bitcoin offers a way to cut out those expensive middlemen, making transfers faster and cheaper. Pretty appealing, right?

I remember my own frustration with high fees back in the day when I was exploring early crypto exchanges. One of the reasons I fell in love with crypto was how it gave the middle finger to unnecessary fees.

2. Financial Inclusion: Banking Without a Bank

Before Bitcoin’s big debut, around 70% of Salvadorans didn’t have access to traditional banking. Think about that for a moment—7 out of 10 people couldn’t save, borrow, or invest through a bank. But with Bitcoin, all you need is a smartphone. Boom—you’re in. It’s a bit like the early days of DeFi, when I was playing around with staking and realizing just how empowering decentralized finance could be.

3. Attracting Investment: The Bitcoin City Dream

Here’s where things get spicy. El Salvador isn’t just adopting Bitcoin—they’re marketing themselves as a crypto-friendly paradise. They even pitched the idea of “Bitcoin City,” a futuristic hub powered by geothermal energy from volcanoes to support Bitcoin mining. (I mean, if your country has volcanoes, you have to use them for something cool, right?)

4. Economic Independence: Shaking Off the Dollar

El Salvador has been tied to the U.S. dollar for decades, which means they’ve had little control over their monetary policy. By adding Bitcoin to the mix, the country hopes to gain a bit more financial independence.

So, What’s the Catch?

Of course, there are risks. Bitcoin’s price volatility is no joke, ask anyone who’s ever bought the top (been there, done that). convincing an entire nation to embrace crypto isn’t exactly easy. But for a country looking to innovate its way out of economic struggles, it’s a gamble that could pay off big time.

Key Takeaway: Could Bitcoin Help More Than Just El Salvador?

El Salvador’s Bitcoin experiment is like a giant case study for the rest of the world. Whether it succeeds or flops, there’s a lot we can learn. For anyone new to crypto, it’s a great reminder of how blockchain technology can solve real-world problems like high fees and financial exclusion.

Asked whether Bitcoin has been a success in El Salvador, Bukele replies, “Yes and no. Bitcoin has not experienced the widespread adoption we had hoped for. While many Salvadorans and the majority of large companies in the country – you can pay with Bitcoin at McDonald’s, supermarkets, and hotels – the adoption among people remains below expectations.”

Bitcoin vs. the U.S. Dollar: El Salvador’s Balancing Act

Before Bitcoin entered the picture, El Salvador’s economy was firmly tied to the U.S. dollar and it still is. Back in 2001, the country adopted the dollar to stabilize its economy, reduce inflation, and encourage foreign investment. For a while, it worked, bringing a measure of financial stability. However, there was a downside: El Salvador lost much of its monetary policy control, relying heavily on decisions made in the U.S.

Fast-forward to 2021, and Bitcoin was introduced not as a replacement for the dollar, but as an additional currency. Now, Bitcoin and the dollar coexist. Businesses are legally required to accept Bitcoin, but prices are displayed in both currencies, and people can choose whether to pay in dollars or Bitcoin.

This dual-currency system creates an interesting dynamic. Bitcoin promises innovation and a step toward financial independence, but the dollar’s stability remains a safety net for a population still adjusting to the concept of cryptocurrencies.

The Volatility Question: Risk or Reward?

Bitcoin’s price volatility is its most significant challenge. Unlike the U.S. dollar, which tends to stay relatively stable, Bitcoin’s value can swing dramatically in a matter of hours. While this is part of what excites crypto enthusiasts, it understandably makes everyday users a bit nervous.

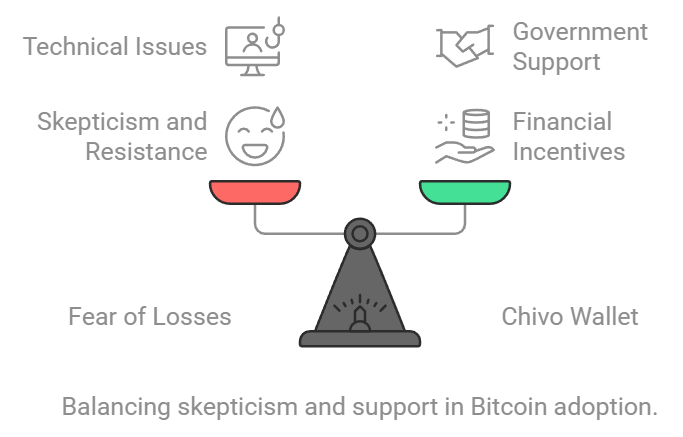

Skepticism Among Salvadorans

When Bitcoin became legal tender, many Salvadorans approached it with hesitation. Some were unsure about how it worked, while others feared the potential for financial losses due to price fluctuations. For a nation accustomed to the steadiness of the dollar, Bitcoin’s unpredictability was a hard sell.

The Chivo Wallet: A Government Push for Adoption

To encourage Bitcoin usage, the government rolled out the Chivo wallet, a state-backed digital wallet designed for Bitcoin transactions. To sweeten the deal, they offered every citizen $30 in Bitcoin for signing up. While the incentive sparked interest, the rollout faced technical hiccups, leaving some users frustrated and others confused about how to use the app effectively.

A Vision for the Future

Despite the bumps along the way, the Salvadoran government remains committed to its Bitcoin experiment. President Nayib Bukele sees Bitcoin as a tool to drive economic growth, reduce poverty, and position El Salvador as a global leader in financial innovation.

The move is undoubtedly ambitious, and whether it succeeds or fails, it has already made waves in the global financial landscape. By adopting Bitcoin, El Salvador has forced the world to consider the potential and the risks of integrating cryptocurrency into mainstream economies.

Global Reactions: A Divided Opinion

El Salvador’s bold decision to adopt Bitcoin as legal tender has sparked a global debate. While some see it as a groundbreaking move, others view it as a high-stakes gamble. The world is watching closely, and the reactions have been as divided as you’d expect for such an unconventional economic experiment.

The Critics: Fear of Financial Chaos

Not everyone is cheering for El Salvador’s crypto adventure. Institutions like the International Monetary Fund (IMF) have been vocal about their concerns. They argue that Bitcoin’s notorious volatility could destabilize the country’s economy and disproportionately impact its most vulnerable citizens.

The IMF even went as far as suggesting that El Salvador backtrack on its decision. But so far, the Salvadoran government hasn’t flinched, staying committed to its vision of a Bitcoin-powered future.

The Supporters: A Vision of Crypto Leadership

On the flip side, Bitcoin enthusiasts and cryptocurrency advocates are thrilled. They see El Salvador as a trailblazer, paving the way for a future where digital currencies are part of everyday life. For these supporters, the country’s experiment could serve as a blueprint for other nations, especially those with similar economic challenges.

Bitcoin evangelists are optimistic that El Salvador’s success could inspire a domino effect, encouraging more countries to explore the potential of cryptocurrencies.

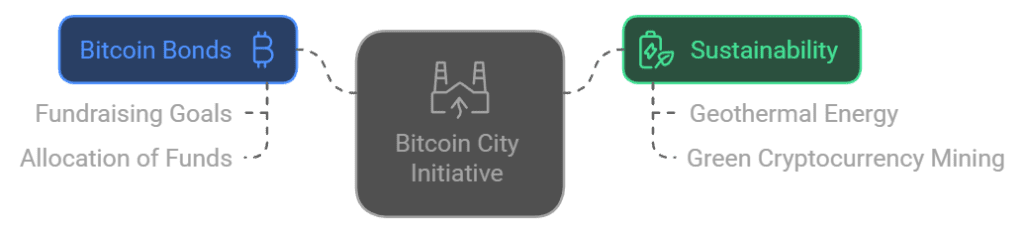

Big Plans: Bitcoin Bonds and the Dream of “Bitcoin City”

El Salvador’s ambitions don’t stop at just adopting Bitcoin. The government has introduced Bitcoin bonds as part of its long-term strategy to fund innovative projects like “Bitcoin City.”

What Are Bitcoin Bonds?

These bonds aim to raise $1 billion. Half of the funds are earmarked for infrastructure development in Bitcoin City, while the other half will go toward buying more Bitcoin. It’s a bold approach, combining infrastructure investment with a bet on the cryptocurrency’s future value.

A Futuristic Bitcoin City

Bitcoin City is envisioned as a tax-free, high-tech hub located near the Conchagua volcano. Why a volcano? Because the city will harness geothermal energy to power Bitcoin mining, making it one of the first crypto projects to prioritize sustainability.

Sustainability and Innovation

By tapping into renewable energy, El Salvador hopes to set an example for eco-friendly cryptocurrency mining. It’s an ambitious project, aiming to position the country as a leader in green tech and innovation, while promoting Bitcoin as a tool for economic growth.

Is El Salvador’s Bitcoin Experiment Working?

More than two years after the adoption of Bitcoin, the results are still mixed. While the government continues to promote Bitcoin and its potential, adoption rates among Salvadorans remain relatively low. Many still prefer using the U.S. dollar, and there are ongoing concerns about Bitcoin’s volatility.

“It brought us investments and tourism.” -President Nayib Bukele

Benefits So Far:

- Lower remittance costs: Bitcoin has, to some extent, lowered remittance fees for those using the Chivo wallet or other crypto services.

- Tourism: El Salvador has seen a boost in tourism, with curious visitors coming to see how the Bitcoin experiment is unfolding.

- Innovation hub: The country has attracted attention from the tech and crypto industries, with some companies setting up operations in El Salvador.

Challenges:

- Low adoption: Many Salvadorans remain hesitant to embrace Bitcoin fully. Concerns about price volatility and technical issues with the Chivo wallet persist.

- International concerns: The IMF and other financial institutions continue to warn about the potential risks to El Salvador’s economy.

Conclusion: A Bold Step Toward the Future

El Salvador’s decision to adopt Bitcoin as legal tender was undoubtedly a bold and risky move. While the country has faced challenges, it has also made strides in putting itself on the global map as a pioneer in cryptocurrency. The full impact of this experiment is yet to be seen, and only time will tell whether Bitcoin will help El Salvador achieve financial growth or lead to further economic complications.

Regardless of the outcome, El Salvador’s Bitcoin experiment has opened up new conversations about the role of digital currencies in the global economy. The world is watching closely, and other nations may follow if the country’s gamble pays off. For now, El Salvador remains the testing ground for what could be a new era of financial innovation.

“I think it could have gone better, but there is still plenty of time to make improvements.“ But above all, „it has not brought us anything negative – on the contrary. In the end, it’s only positive.” -President Nayib Bukele

source –Bitcoinblog

More about BTC Regulations