Crypto or Stocks 2024? My Chaotic Investment Journey

Crypto or stocks? When I first dipped my toes into investing, I thought it would be straightforward. Stocks seemed like the mature, sensible option—buy shares, watch them grow, retire rich. Then I discovered cryptocurrency, and my portfolio went from “slow and steady” to “hold onto your seat.”

If you’re trying to decide between the two, let me share what I’ve learned—through mistakes, experiments, and a couple of facepalm-worthy moments. Hopefully, you can avoid the worst of my blunders while finding your own path.

Investments in Stocks: Stability, but at a Price

Stocks were my first love in investing. They felt safe. Everyone I knew owned a slice of Apple or Tesla, and financial news was always reassuring: “Invest for the long term,” they’d say. So, I did.

I bought shares of big, reliable companies and waited for the magic to happen. At first, it felt great. My portfolio inched upward, dividends trickled in, and I felt like I’d cracked the code. But soon, I hit a wall.

The problem? Stocks don’t exactly wow you on a daily basis. For someone like me, who thrives on excitement, checking my portfolio became about as thrilling as waiting for paint to dry. Sure, they were growing, but the returns felt glacial compared to the stories I was hearing from the crypto world.

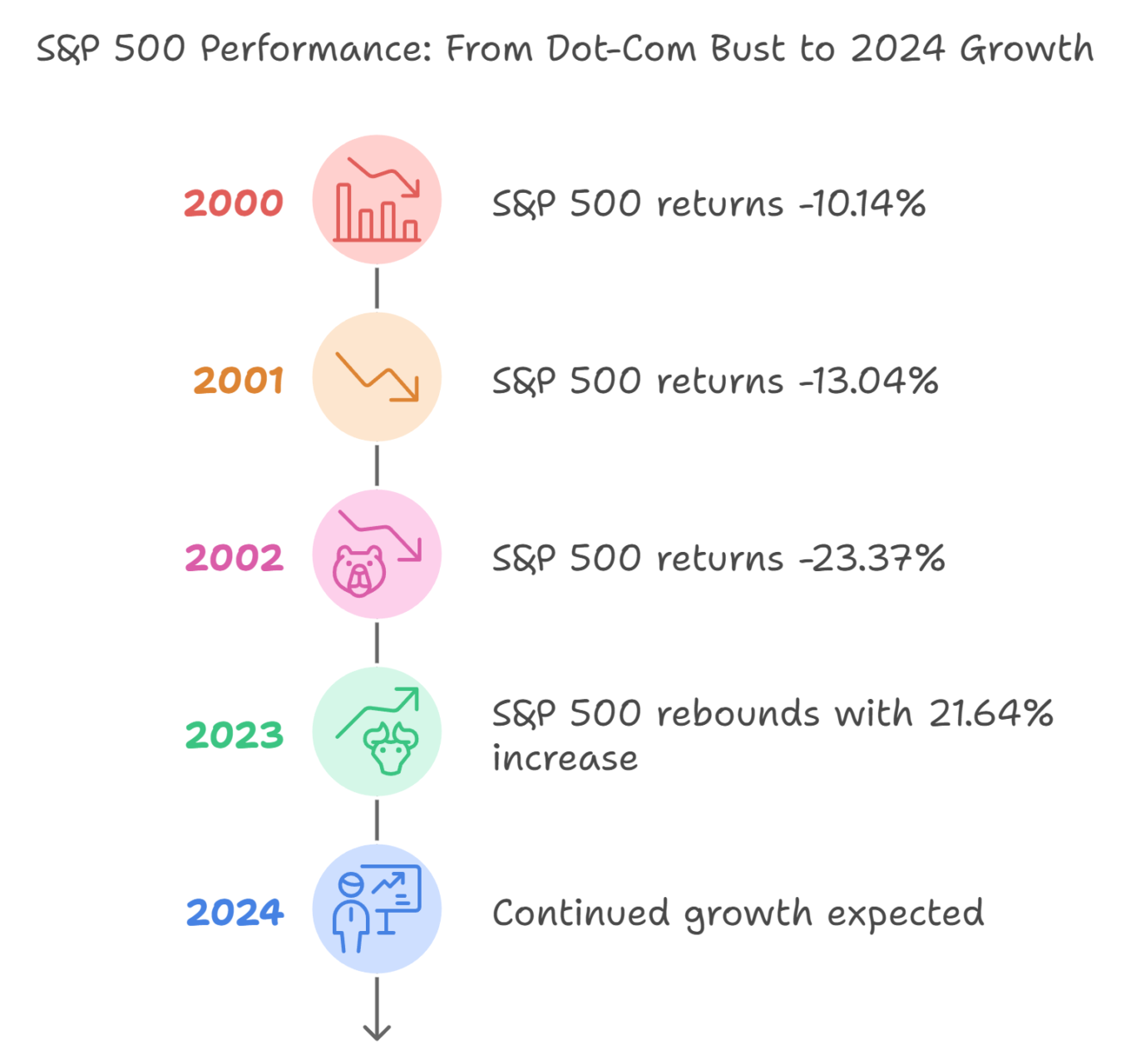

Stock Market Historical Returns

The S&P 500, a benchmark for stock market performance, provides a clear lens for understanding long-term returns. From 2000 to 2002, it experienced significant downturns during the dot-com bubble burst, with returns of -10.14% (2000), -13.04% (2001), and -23.37% (2002). These were difficult years for investors but underscored the importance of a long-term perspective.

In contrast, over the last decade, the S&P 500 has delivered strong returns, averaging around 12% annually. Notably, in 2023, the S&P 500 rebounded with a 21.64% increase following a tough 2022. Early estimates for 2024 indicate continued growth driven by strong corporate earnings and improving economic conditions.

Investments in Crypto: A Wild Ride with Lessons in Humility

Then came crypto. Bitcoin had just skyrocketed in price, and my Twitter feed was full of people making ridiculous gains. It looked like the fast lane to wealth, and I wanted in. Why wait for 10% annual returns when I could make 10% in a day?

But crypto isn’t just volatile; it’s merciless.

My first crypto purchase was Bitcoin, and within a week, it dropped 20%. I panicked and sold, locking in a loss—only to watch it rebound higher than ever a month later. That was my first lesson: Crypto rewards patience, but it also punishes fear.

Then came altcoins.

If you’ve ever bought a coin because someone promised it was “the next Ethereum,” you already know where this is going. I threw money at projects with ridiculous names, thinking I was early to the party. Half of them ended up worthless. The rest taught me that hype alone doesn’t equal value.

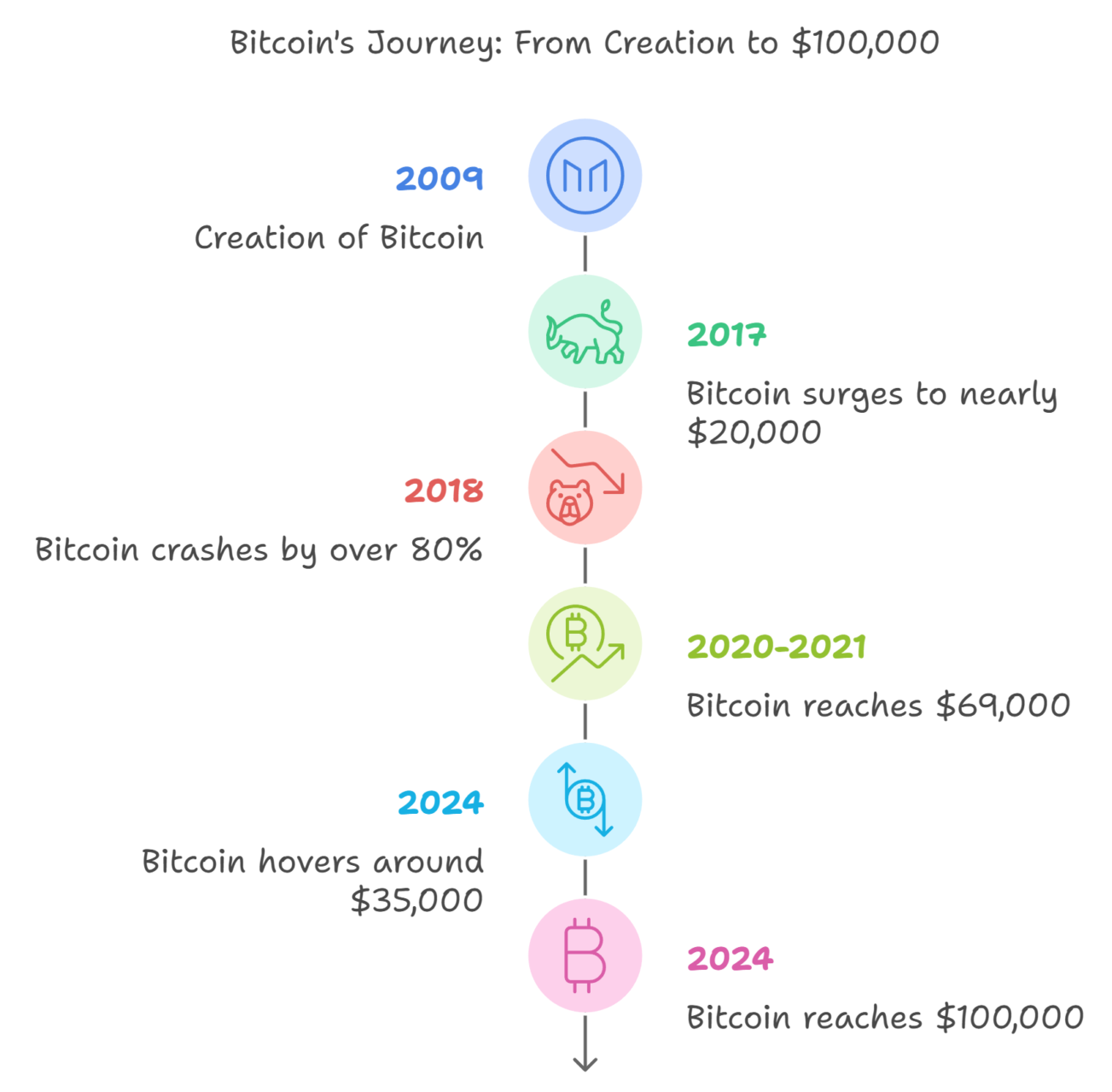

Bitcoin’s Volatility and Trends

Bitcoin’s trajectory paints a dramatically different picture. Since its creation in 2009, Bitcoin has gone through cycles of boom and bust, showcasing both extreme volatility and growth.

For instance:

During the 2017 bull market, Bitcoin surged from under $1,000 to nearly $20,000, only to crash by over 80% in 2018.

The 2020-2021 bull run saw Bitcoin reach $69,000, largely driven by institutional adoption, increased public interest, and monetary policy shifts during the pandemic.

In 2024, Bitcoin was hovering around $35,000, reflecting renewed optimism as adoption continued to grow, including major institutional investments at the time of writing this article BTC is hovering around $100,000, you can now say it’s volatile, but who is enough in Crypto we all knew it was going to happen.

Crypto or Stocks: What I’ve Learned

Let me confess something upfront: I don’t own any stocks these days. Not a single one. It’s not that I haven’t tried but now, my investment world revolves around Bitcoin, a handful of altcoins, and, when I’m feeling spicy, the occasional memecoin gamble.

Why? Because, honestly, I don’t think stocks are cutting it anymore. With inflation climbing and traditional markets barely keeping pace, I can’t help but feel like the stock market is playing defense while crypto is sprinting toward the future.

What “Experts” tell you

1. Risk Tolerance

Stocks are perfect for those who like stability. Even during rough markets, they don’t crash the way crypto can

Crypto? Let’s just say you should only invest what you’re prepared to lose.

It’s thrilling, yes, but heart-stopping when things go south.

2. Time Horizon

Stocks are a slow burn. Think decades, not weeks.

Crypto, on the other hand, moves fast. You could see massive gains (or devastating losses) in a matter of days.

3. Research Matters

Stocks are backed by financial reports, revenue, and decades of performance history.

Crypto? You’re often betting on ideas, whitepapers, and a community that may or may not stick around. Knowing the tech and the team behind a project is essential.

My Answer To “Experts”

1. about Risk Tolerance

Traditionally, stocks have been seen as the safer option. They don’t usually crash as dramatically as crypto does, even during rough markets. But let’s be real—crypto isn’t as volatile as it used to be.

Sure, Bitcoin and altcoins can still experience wild swings, but it’s not the Wild West it once was.

That said, whether it’s stocks or crypto, you should only invest what you’re prepared to lose.

Anything can happen. A bad earnings report can tank a stock, just like a failed upgrade can crash a crypto project. But for Bitcoin? Honestly, I don’t lose sleep over it—it feels like the one true constant in this space.

2. about Time Horizon

People often say stocks are a long game—think decades, not weeks. But here’s the twist: stocks and crypto both seem to follow a four-year cycle.

Stocks have their bull and bear markets tied to broader economic trends, while Bitcoin’s halvings create a rhythm that seems to ripple across the entire crypto market.

So, while crypto is still faster-paced than stocks, the two aren’t as different as they used to be. The key? Understanding the cycles and riding them smartly.

3. Research Does Matter!

Whether it’s stocks or crypto, research is non-negotiable. Stocks come with financial reports, revenue data, and decades of performance history. But even that doesn’t guarantee safety—companies go bankrupt, markets crash, and surprises happen.

Crypto, on the other hand, often feels like betting on potential.

You’re analyzing whitepapers, technology, and the strength of a community. And yes, it’s true—anything can happen here, too.

But Bitcoin? It’s in a league of its own. With its fixed supply and proven resilience, I’d argue it’s less of a gamble than most people think.

Why Mix Both?

Let’s face it—no single investment style is flawless. Stocks are your “set it and forget it” option. Buy, hold, and don’t even peek at the portfolio for years. They’re steady, like a tree slowly growing roots. Crypto, though? That’s the adrenaline rush—the Ferrari of investing, but only if you know when to hit the gas. honestly you can use the same strategy, buy bitcoin and leave it.

Here’s what I’ve learned: in stocks, patience wins. But in crypto, timing is everything.

My Crypto Strategy

When the bull market starts heating up, I focus on stacking Bitcoin. It’s the foundation of my crypto game. As the market builds momentum and altcoin season kicks in, I swap a fair chunk of my Bitcoin into solid, stable altcoins. Think projects with utility, strong teams, and hype. But I always keep a small slice for memecoins—it’s risky, but sometimes worth the gamble.

when you feel bears are coming

When I feel the bull run is nearing its end (and believe me, the market gives you clues), I swap most of my holdings back into Bitcoin. Why? Because it’s resilient and less prone to crashing when the frenzy fades. I leave a small portion in stablecoins like USDT, but not too much. Why? I don’t fully trust stablecoins—there’s always that nagging risk they might depeg or implode during market chaos.

you can check out our tools to better understand the current market position.

The Sweet Spot

For stocks, you don’t need to do much. Buy your index funds or shares in reliable companies, and let time do its thing. It’s the tortoise in the race—slow, sure, and surprisingly effective over decades.

With crypto, though, you need a plan. Know when to stack Bitcoin, when to ride the altcoin wave, and when to pivot back. The key? Keep your emotions in check. The market rewards strategy, not panic.

Big Wins of This Approach

- Minimized Risk: Stocks keep your foundation steady while crypto provides the fireworks. You’re not all-in on either side.

- Maximized Gains: Timing altcoin cycles can supercharge returns, while Bitcoin gives you a reliable fallback.

- Flexibility: By keeping a mix of Bitcoin, altcoins, and a small stablecoin reserve, you’re prepared for any market swing.

Final thought? Stocks and crypto don’t just coexist—they complement each other. Stocks are your slow, steady income. Crypto is your high-risk, high-reward adventure. Together, they make investing dynamic and, yes, a little fun.

Now, your turn: Are you more of a stock market steady climber or a crypto adrenaline junkie? Let me know, and let’s swap stories.

Sources: Statmuse, tradingview

More about BTC