Bitcoin Price 2025: Crazy Market Predictions!

Bitcoin Price 2025? Experts have bold forecasts that could make anyone excited. we all have our price predictions, but everything can happen lets dive in.

Bitcoin Price 2025: Key Factors That Could Drive Massive Growth

Curious about where Bitcoin might be heading by 2025? The outlook is exciting for BTC Holders with several factors paving the way for major price growth. Let’s magnify the reasons that could push Bitcoin to new highs in the coming years.

“Bitcoin is the one asset that was always going to soar if Trump returned to the White House,” Russ Mould, investment director at AJ Bell, said in emailed comments. Forbes

1. Growing Interest

More financial institutions are jumping into Bitcoin as a key asset, with big names like BlackRock, Fidelity taking a closer look, while MicroStrategy and Tesla already holding thousands of bitcoins already. this results positive sentiment growth and more and more individuals are getting involved, Bitcoin Price 2025 is becoming kind of intuitive as This steady influx of institutional buying could drive demand and impact price positively.

2. Fixed Supply

Bitcoin’s design caps its supply at 21 million coins, making it a scarce asset similar to digital gold. Roughly every 2 weeks BTC mining difficulty increases making it harder to mine. together with more people become interested, this limited supply could create upward pressure on prices.

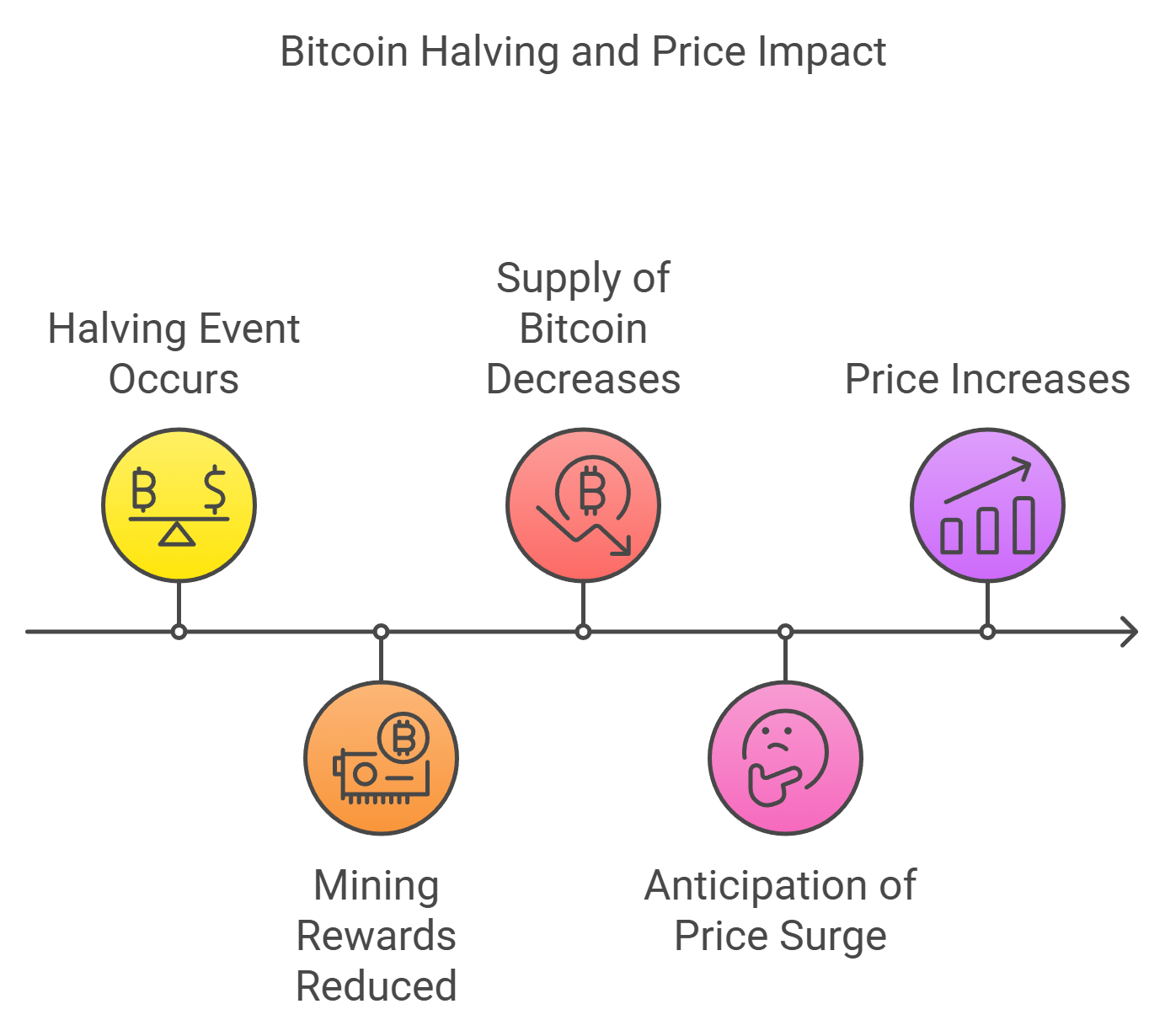

3. The Halving Effect

Approximately every four years, Bitcoin experiences a halving event, which reduces the mining rewards by 50%. The last halving took place in May 2020, dropping rewards from 12.5 to 6.25 BTC per block. Historically, these halving events have been followed by significant price increases as the new supply of Bitcoin entering the market declines. After the 2020 halving, Bitcoin’s price saw impressive growth, rising from around $9,000 at the time of the event to nearly $30,000 by the end of the year. This trend has led many to anticipate a similar surge following the after halving event, as reduced supply typically increases scarcity and, potentially, demand. so I would say Bitcoin price 2025 Q1 can easily go up to $150k

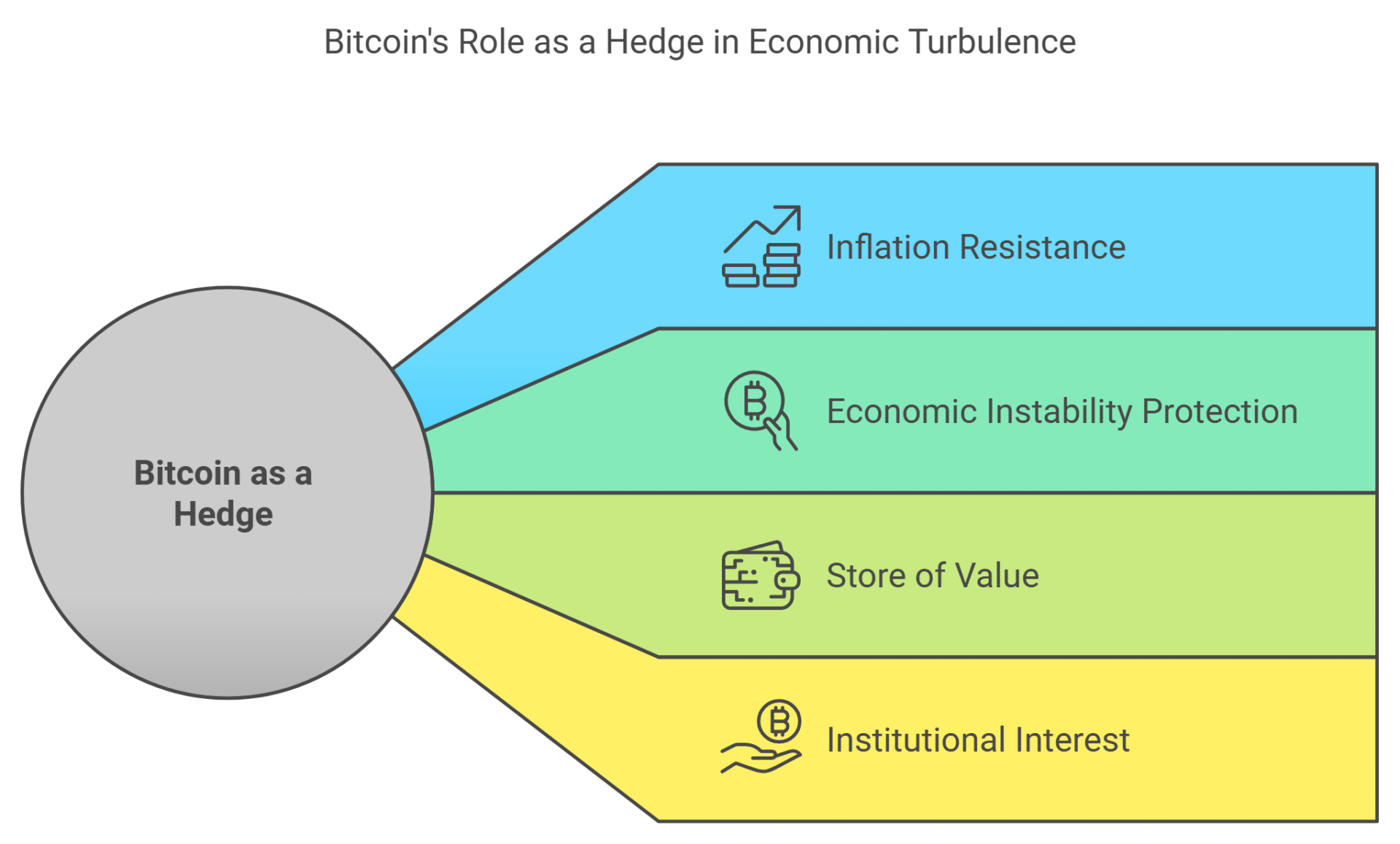

4. Inflation

With rising inflation and economic instability affecting the whole world, more people are starting to view Bitcoin as a discovery against all it. As a decentralized asset, Bitcoin isn’t controlled by any government or central bank, which gives it an edge in uncertain times.

traditional currencies lose value due to inflation, Bitcoin’s fixed supply of 21 million coins means it can’t be “printed” like money. This scarcity makes it an attractive option for those looking for a store of value that isn’t as vulnerable to the same economic forces that affect fiat currencies. In fact, many investors are starting to see Bitcoin as a form of “digital gold,” a way to protect their wealth from inflation or political instability.

As inflation rates soar and economies struggle, the idea of having a limited-supply asset that operates outside the control of governments is becoming more attractive to people who want to safeguard their financial future. With its potential to act as a hedge against inflation, Bitcoin is increasingly drawing the attention of both individual investors and big institutions alike. Read more about BTC as a hedge against inflation

Bitcoin as an investment

Plan B famous for his predictions, “anticipates a massive wave of capital from new Bitcoin exchange-traded funds (ETFs) to drive the Bitcoin price up to $150,000 by the end of December 2024. By January 2025, he foresees a resurgence of crypto companies back to the US, which would push the price further to $200,000”.

We have been talking about Bitcoin´s Pros the whole article now lets talk about Bitcoin as an investment. the main purpose why corporations and individuals buy bitcoin is yes they wanna get Rich!

Bitcoin is a go-to investment for many people, and it’s easy to see why. As the world of finance evolves, Bitcoin stands out as a unique asset that offers the potential for impressive returns. Unlike traditional investments like stocks or bonds, Bitcoin is decentralized, meaning it isn’t tied to any single country’s economy or financial system.

This can make it a more flexible and exciting option for those looking to diversify their investment portfolios. some say it´s volatile but i see it as it is, it just has it´s own cycle as any other assets you can purchase on the market. What makes Bitcoin especially attractive is its potential for long-term growth. Since its launch in 2009, Bitcoin has seen significant price increases, making early investors quite happy with their returns.

Summary:

Bitcoin is increasingly seen as an exciting investment opportunity. With its decentralized nature, limited supply, and potential for long-term growth, it offers a unique way to diversify your portfolio. While it can be volatile in the short term, many investors view Bitcoin as a store of value and a hedge against inflation, making it an attractive option for those looking to capitalize on the evolving financial landscape.

Disclaimer:

I’m not a financial advisor, Investing in Bitcoin involves risk due to its volatility and unpredictable price movements. Always do your own research and consider seeking advice from a financial professional before making any investment decisions.