Market Liquidity: Complete Guide for Crypto Investors

Have you ever tried to buy or sell cryptocurrency, only to find the price fluctuates wildly with each transaction? This is often due to a lack of something essential: market liquidity. But what exactly is liquidity, and why does it matter so much in crypto?

In this article, we’ll dive into market liquidity in the simplest terms, discuss why it’s important, and explore how it affects crypto traders and investors.

What is Market Liquidity?

Market liquidity refers to how easily an asset can be bought or sold without affecting its price. The more liquid an asset is, the easier it is to trade at a stable price.

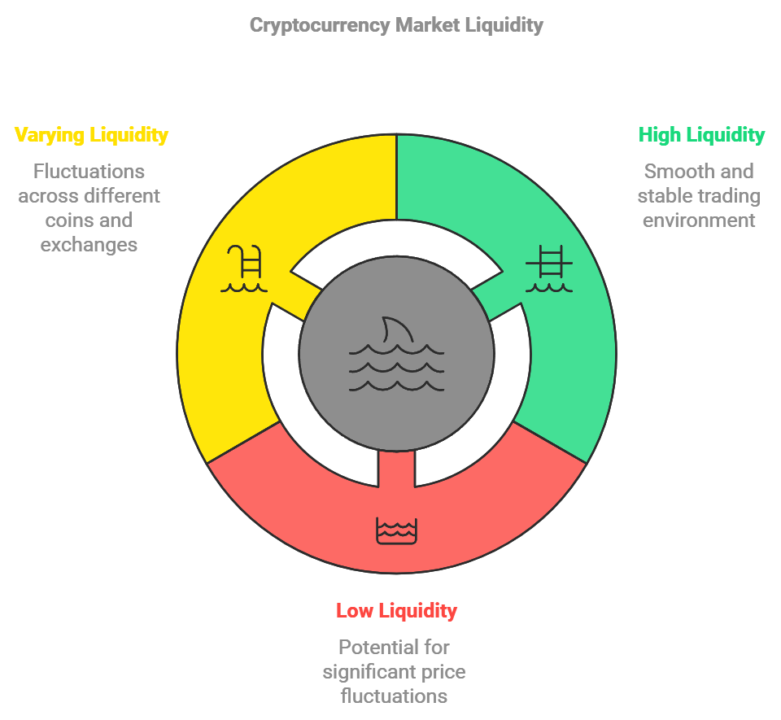

In traditional finance, assets like stocks or government bonds are highly liquid, meaning they can be traded quickly with little price impact. But cryptocurrency? That’s a different story. Liquidity can vary drastically between different coins, exchanges, and even times of day.

Think of liquidity as a pool of water. If the pool is deep, you can scoop out water without lowering the level too much. But if it’s shallow, each scoop has a big impact on the water level. In crypto, high liquidity means trades can happen smoothly; low liquidity, however, can cause big price swings.

Why is Liquidity Important in Crypto Markets?

In the world of crypto, liquidity is a game-changer. Here are a few reasons why it’s so crucial:

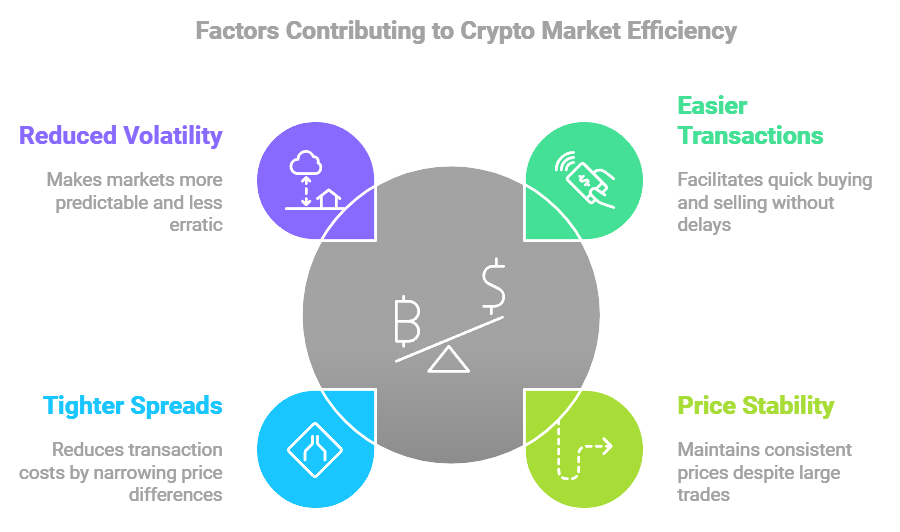

- Easier Transactions: High liquidity means you can quickly buy or sell crypto without waiting for a matching order.

- Price Stability: When liquidity is high, the market can absorb larger trades with less impact, keeping prices stable. In low-liquidity markets, prices tend to fluctuate more.

- Tighter Spreads: Liquidity keeps the bid-ask spread small. This is the difference between the price buyers are willing to pay (bid) and the price sellers want (ask). A tight spread means lower transaction costs for traders.

- Reduced Volatility: High liquidity often results in lower volatility, which makes markets more predictable. In crypto, however, even high-liquidity assets like Bitcoin can be more volatile than traditional assets.

How Does Liquidity Impact Traders and Investors?

Let’s take a closer look at how liquidity affects trading and investing in crypto.

- Impact on Trading Strategies

Day traders and swing traders rely heavily on liquidity. High liquidity allows them to execute quick trades without moving the market too much. In low-liquidity markets, however, large trades can shift the price, creating “slippage,” which is the difference between expected and actual trade prices.

- Risk for Long-Term Investors

Even for long-term holders, liquidity matters. Imagine holding a large amount of a lesser-known altcoin. When it’s time to sell, low liquidity could mean you’ll have to settle for a lower price or wait longer to find buyers.

- Effect on New Projects

New crypto projects often struggle with liquidity. In early stages, these assets might have low trading volumes, making them more volatile and riskier to trade. This is one reason why institutional investors tend to stick to established, high-liquidity assets like Bitcoin and Ethereum.

How to Measure Liquidity in Crypto Markets

There are a few common ways to measure liquidity in the crypto world. Understanding these can help you make better trading decisions.

- Trading Volume

High trading volume indicates more liquidity. Volume measures how much of an asset is traded over a specific period. In general, the higher the volume, the easier it is to buy or sell at a stable price. - Bid-Ask Spread

A small bid-ask spread indicates high liquidity, while a large spread shows lower liquidity. For example, if the bid price is $10,000 and the ask price is $10,001, the spread is narrow—indicating good liquidity. - Order Book Depth

The order book shows all buy and sell orders for an asset on an exchange. The deeper the order book, the more liquid the asset. Deep order books reduce the impact of large trades, helping to keep prices stable.

Examples of High and Low Liquidity Cryptocurrencies

Let’s look at a few examples to put this into context.

High Liquidity: Bitcoin (BTC) and Ethereum (ETH)

Bitcoin and Ethereum are the most traded cryptocurrencies, which makes them highly liquid. These assets have deep order books and tight bid-ask spreads. If you want to trade $1 million worth of Bitcoin, you can do it with minimal impact on the price.

Low Liquidity: Lesser-Known Altcoins

Many altcoins, especially those newly launched, have low liquidity. Trading a significant amount can cause price swings. Imagine trying to buy $1 million worth of a low-cap coin; the price could spike during your trade, making it more costly and risky.

What Factors Affect Liquidity in Crypto Markets?

Liquidity doesn’t exist in a vacuum. It’s affected by several factors, which vary across different markets and periods.

- Trading Volume: Popular assets naturally have more buyers and sellers, increasing liquidity.

- Market Depth: Exchanges with deeper order books can offer higher liquidity. Centralized exchanges (CEXs) Binance generally provide deeper order books than decentralized ones (DEXs) Uniswap.

- Time of Day and Market Events: Liquidity can change based on time and global events. For example, liquidity may drop during weekends or holidays when fewer traders are active. Big news events or market crashes can also impact liquidity.

- Regulation: Regulatory clarity often boosts liquidity by attracting more participants, including institutional investors. When regulations are unclear, liquidity can suffer as investors stay cautious.

- Institutional Involvement: More institutional money entering crypto boosts liquidity. Institutions bring larger volumes, creating a more stable environment for retail traders.

Frequently Asked Questions about Market Liquidity

Let’s address some common questions around market liquidity.

Q: Is high liquidity always a good thing?

A: Generally, yes. High liquidity allows for smoother transactions and better price stability. However, it can make short-term price gains harder to achieve since prices don’t jump as easily.

Q: Can low liquidity be beneficial?

A: For some, yes. Low-liquidity markets can offer bigger profit opportunities due to larger price movements. However, they come with higher risks.

Q: How do I find the liquidity of a cryptocurrency?

A: Check the trading volume on popular exchanges and look at the bid-ask spread. Many platforms, like CoinMarketCap, provide this data.

Q: Does liquidity vary across exchanges?

A: Absolutely. Different exchanges can have varying levels of liquidity for the same asset. Larger, established exchanges tend to have more liquidity due to higher user activity.

The Future of Liquidity in Crypto Markets

As the crypto market matures, liquidity will likely improve. Several factors could drive this change:

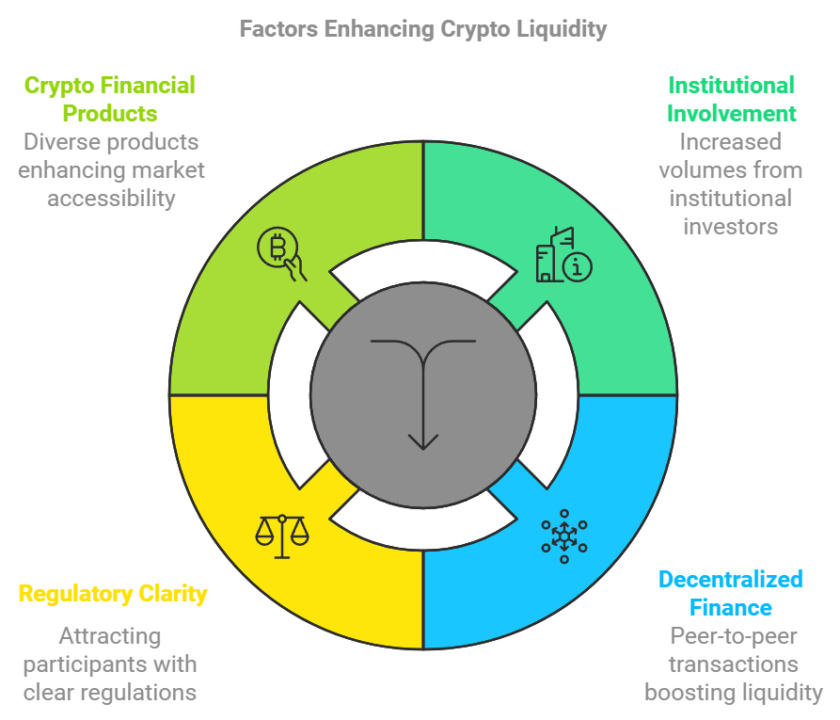

- Institutional Involvement: More institutions entering the space will bring higher volumes, leading to increased liquidity.

- Decentralized Finance (DeFi): Decentralized exchanges are becoming more popular, allowing for more peer-to-peer transactions and improving liquidity, even for less popular assets.

- Regulatory Clarity: Clear regulations could attract more participants, leading to a boost in market liquidity.

- Crypto Derivatives and Financial Products: With more products like futures, options, and ETFs, crypto markets are becoming more liquid and accessible to different types of investors.

In Summary: Why Market Liquidity Matters

In crypto, market liquidity isn’t just a technical term. It impacts everything—from price stability to trade execution. Understanding liquidity can help traders and investors make better decisions, especially in a market known for volatility.

As crypto evolves, liquidity will play an even bigger role in determining the success and accessibility of different projects. So, whether you’re buying your first Bitcoin or holding altcoins, keeping an eye on liquidity can give you a significant edge.

learn more about Decentralized Finance