BTC’s Market Control: Why Bitcoin Dominance Is the Ultimate Key Indicator

If you’ve been in the crypto space for a while, you’ve probably heard the term Bitcoin dominance thrown around a lot. But what does it mean, and why is it important for both Bitcoin and altcoins? Let’s break it down in a way that makes sense whether you’re a crypto newbie or someone who’s been around since the early days.

“Bitcoin is a tool for freeing humanity from oligarchs and tyrants, dressed up as a get-rich-quick scheme.” – Naval Ravikant, former CEO of AngelList

Understanding Dominance

At its core, Bitcoin dominance refers to the percentage of the total value of the entire cryptocurrency market that Bitcoin holds. Think of it like the big guy on the block when Bitcoin’s dominance is high, it means BTC is holding a bigger chunk of the market compared to all the other altcoins.

When Bitcoin is rallying or when the market is struggling, Bitcoin tends to dominate more because investors often seek out the relative safety of BTC, leaving altcoins behind. I remember when I first got into Ethereum mining back in 2016, seeing Bitcoin dominance rising and falling gave me some key insights into market trends.

Why Does Bitcoin Dominance Matter?

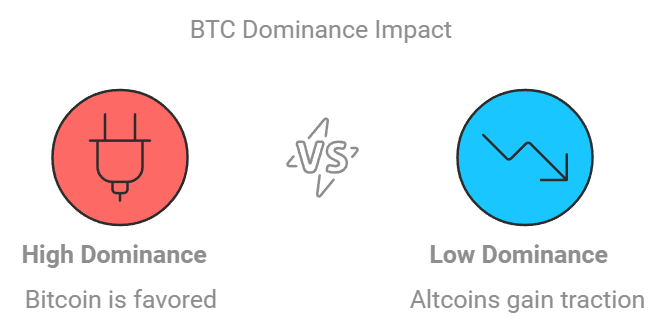

So why should you care about Bitcoin dominance? Well, it’s a quick way to understand where the market’s attention is focused. If you’re holding altcoins (like me Ethereum and others), Bitcoin’s dominance can impact their price movements. A high Bitcoin dominance means altcoins are usually taking a backseat. But when dominance drops, altcoins often make a bigger splash, attracting more speculative investments.

It’s also helpful in figuring out whether Bitcoin or altcoins are the current market drivers. When Bitcoin leads, the market’s more focused on stability. When altcoins surge, that’s when you get those exciting, high-risk, high-reward moments where new projects can take off.

“[Virtual currencies] may hold long-term promise, particularly if the innovations promote a faster, more secure and more efficient payment system.”—Ben Bernanke, Chairman of the Federal Reserve

Historically, Bitcoin dominance has been a key indicator of market trends. It tends to rise during bear markets and drop when altcoins, especially during a bull market, experience massive inflows.

How Bitcoin Dominance Works

Bitcoin’s dominance is essentially a reflection of how much capital flows into Bitcoin relative to the rest of the crypto space. If Bitcoin’s price rises faster than altcoins, its dominance increases. But if altcoins rally more aggressively, the dominance falls.

For example, in 2021, during the peak of the bull run, Bitcoin dominance fell from around 70% in January to below 40% by the end of the year. This happened as a result of booming interest in DeFi (decentralized finance), NFTs (non-fungible tokens), and layer-1 blockchain protocols like Solana and Avalanche.

Bitcoin dominance also rose in 2022 as the market cooled down, and investors retreated from altcoins back to Bitcoin, which is often seen as a “safe haven” asset in the crypto world.

Bitcoin Dominance in Past Bull Runs

2017 Bull Run

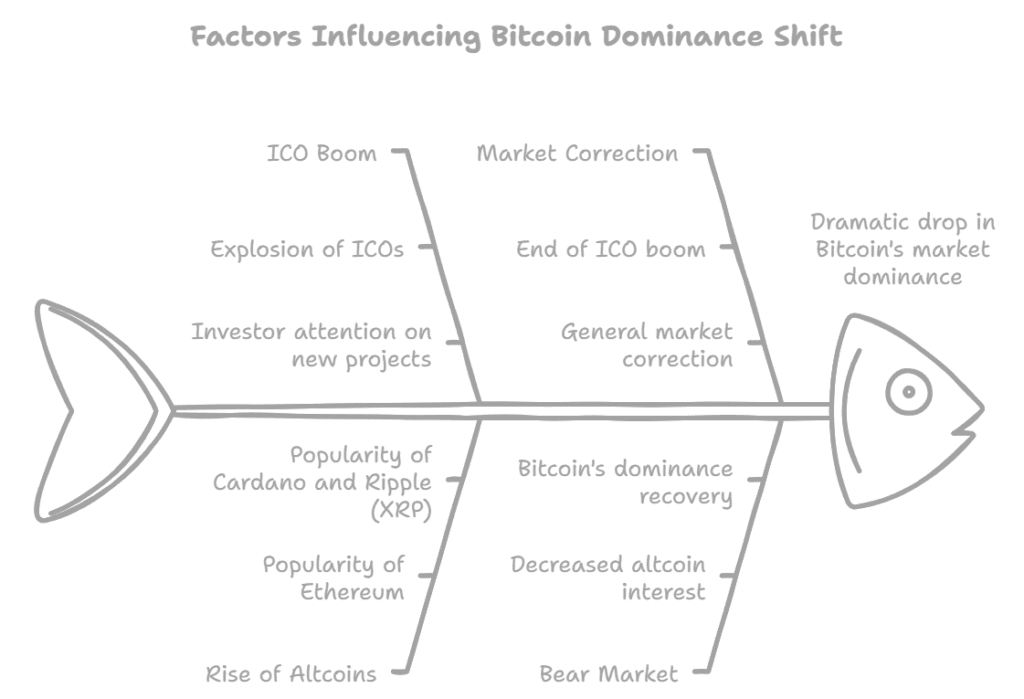

The 2017 bull run is a classic example of how Bitcoin dominance can shift dramatically. At the start of the year, Bitcoin held a dominance of over 85%, reflecting its near-total control over the market. However, by January 2018, Bitcoin’s dominance had plummeted to around 32%.

This massive drop was fueled by the explosion of Initial Coin Offerings (ICOs) and altcoins like Ethereum, Cardano, and Ripple (XRP), which garnered significant investor attention. The end of the ICO boom, along with a general market correction, led to a bear market in 2018, and Bitcoin’s dominance began to climb back as altcoin interest waned.

2021 Bull Run

Fast forward to 2021, Bitcoin’s dominance tells a similar, yet updated story. At the start of 2021, Bitcoin’s dominance was just over 70%, similar to its 2017 peak. However, as interest in DeFi protocols, NFTs, and the Ethereum network grew, Bitcoin dominance started to decline.

By December 2021, it had dipped below 40% again, as many altcoins, especially those tied to decentralized applications (dApps), saw massive price surges. This period is often referred to as “alt season,” where the altcoin market tends to outperform Bitcoin.

Despite this drop in dominance, Bitcoin still reached an all-time high of $69,000 during this time, showing that Bitcoin can rise in value even when its share of the market decreases. This dynamic highlights the growing maturity of the altcoin space and the diversification of investor interests beyond just Bitcoin.

The 2024 Scenario: Bitcoin Dominance at 53.6%

As of Q3 2024, Bitcoin dominance stands at 53.6%, a significant rebound from the lows seen in 2021 and early 2022. This marks an increase from around 40% in early 2023, and it’s indicative of a few key market dynamics:

- Institutional Investment: More institutional investors are returning to Bitcoin as a safe store of value, particularly amid regulatory uncertainty surrounding altcoins.

- Market Maturity: As the market matures, Bitcoin is increasingly viewed as “digital gold,” while altcoins are seen as higher-risk investments with greater volatility.

- Consolidation in the Altcoin Market: Many altcoin projects have faded away or consolidated, leaving only the strongest contenders, which means Bitcoin’s dominance rises as the speculative mania around smaller altcoins fades.

- This all above stated gives us reason to believe we are gonna see BTC pumping.

see current BTC dominance

Why BTC Dominance is Rising Again

Several factors are contributing to Bitcoin’s rise in dominance during 2024:

- Macroeconomic conditions: Bitcoin is seen as a hedge against inflation and a store of value in uncertain times. With increasing macroeconomic instability, more investors are looking at Bitcoin as a safe haven.

- Altcoin fatigue: Many altcoins have experienced significant price declines in the bear market that followed the 2021-2022 boom. This has led to a shift back to Bitcoin, as it’s perceived to be more stable and secure.

- Bitcoin ETFs: The approval of Bitcoin Exchange Traded Funds (ETFs) has driven institutional money into Bitcoin, further boosting its market share and helping its dominance climb.

What Happens Next? Will Altcoins Surge Again?

Historically, after Bitcoin dominance peaks around 55-60%, there is often a shift back into altcoins, igniting what’s known as “alt season.”

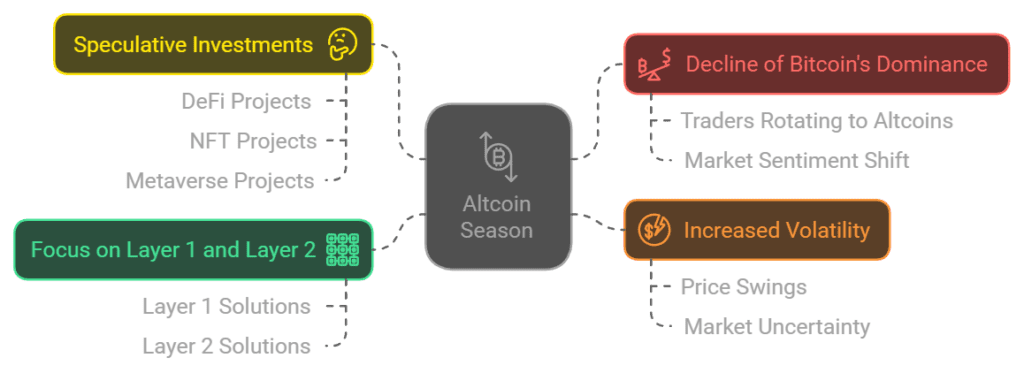

- Altcoin Season: When Bitcoin’s dominance starts to fall, it’s usually a signal that traders are rotating out of Bitcoin and into higher-risk altcoins, which often leads to explosive gains in the altcoin market. Alt seasons are characterized by:

- Higher volatility in altcoins.

- Speculative capital flowing into new projects, particularly in DeFi, NFT, and metaverse-related sectors.

- A focus on Layer 1 and Layer 2 blockchain solutions as investors look for the “next big thing.”

- Impact on Altcoins: As Bitcoin’s dominance decreases, we often see a strong rally in alternative cryptocurrencies. Projects with strong fundamentals, clear use cases, and real-world utility tend to perform best.

For example, during the 2021 alt season, projects like Solana, Avalanche, and Polygon experienced massive price increases as investors looked for faster, cheaper, and more scalable alternatives to Ethereum.

Key Factors to Watch in the Next Cycle

If Bitcoin dominance continues to rise, together with Fear and greed index as writing this article is 48. it could signal more conservative market conditions, where investors prefer the safety of Bitcoin over the speculative nature of altcoins. However, if history is any guide, once Bitcoin dominance reaches around 55-60%, we could see a resurgence in altcoins.

Here’s what to watch for:

- Market sentiment: As optimism returns to the crypto market, expect more speculative capital to flow into altcoins.

- Ethereum’s role: As the leading altcoin, Ethereum’s performance often dictates the broader altcoin market. With Ethereum’s upcoming upgrades, it could be a key player in the next alt season.

- Layer 2 solutions: With scalability solutions like Optimism, Arbitrum, and Base gaining traction, they may capture significant market share, impacting Bitcoin dominance.

“If crypto succeeds, it’s not because it empowers better people. It’s because it empowers better institutions.” – Vitalik Buterin, Co-Founder of Ethereum

Conclusion: Bitcoin Dominance as a Key Market Indicator

Bitcoin dominance is a powerful tool for understanding the overall dynamics of the cryptocurrency market. It helps traders and investors assess the balance between Bitcoin and altcoins, as well as the broader market sentiment.

In conclusion, Bitcoin dominance, combined with the Fear and Greed Index, suggests we are on the path to seeing BTC reach a new all-time high (ATH) soon. Historically, this pattern shows that money flows into Bitcoin first, pushing its dominance higher. Once Bitcoin hits its peak, the market typically shifts, and capital moves into altcoins, leading to their explosive growth. Watching these indicators closely can give us a good sense of where the market is headed next.

it helps understand the current position of the market, stay informed, and be prepared for both Bitcoin’s rise and the coming altcoin season..

more about Altcoins